Monday, August 1, 2011

Ignorance is curable. Stupid is Forever©

There is no such thing as a jobless recovery!

There is Nothing “Wrong” with America’s Job Engine. It’s Just Starved for Fuel

“What’s Wrong with America’s Job Engine?” Our Author asks.

Please read: http://owl.li/5QtoQ

Our response follows:

It’s hard to know where to begin with this one. How about here? There is no such thing as a jobless recovery! Jobless recovery is an oxymoron. If we are “jobless” we don’t have a recovery. It’s as simple as that. A full seventy percent of our GDP is driven by consumer spending. If unemployment is nine percent, and rising, where is the recovery? We keep telling you there isn’t one, the recession is not over and the economic data continue to bear that out. Consider the ridiculous “expert” driven GDP estimates. The first quarter was revised down from 1.9% to .4%. Then they have the nerve to suggest the second quarter at 1.3% (advanced estimate which will also be revised) was “unexpected.” These guys have a better job than weather forecasters!

Of course CEO’s see no demand out there. Did we mention unemployment is over nine percent and the consumer drives GDP? GDP is a great proxy for demand so you can see it takes very little ‘smart’ to predict demand will continue to be low.

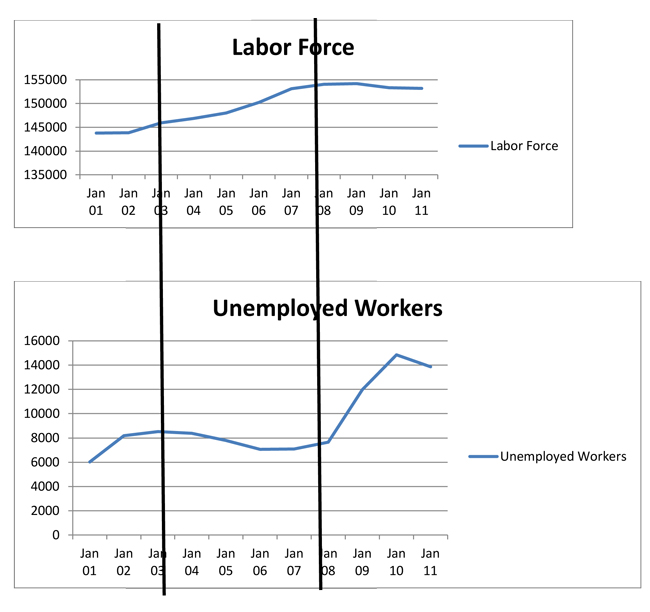

The author asserts that while output, profits and the labor force have grown over the past ten years the number of employed people (jobs) has fallen. They say you can get numbers to say anything… Those assertions are utterly ridiculous as the graphics below will show. The number of unemployed people has not followed the output earnings trend for ten years. The unemployed have become so in the last two and a half years!

Source: www.bls.gov

As you can see, after 2002 the number of unemployed workers actually decreased while the available labor force increased. It is only since mid 2007 that the rate of unemployed people has out accelerated the increase in the labor force. Hard to deny policy and anticipation of policy affects economic activity.

To say that sales have come back as a general statement is moronic no matter who says it. Can it be true in narrow examples? Sure. But we again refer you to the .4%/1.3% GDP numbers from today. Sales HAVE NOT returned.

Construction and small business are not failing to hire early in the recovery because THERE IS NO RECOVERY. They were not “crippled by the credit bust.” They were, are and will continue to be crippled by a lack of demand…PERIOD. The “confidence” factor referred to by the author is based on…anticipation of sustained DEMAND, DUH.

There is no “phenomenon” regarding a change in the way employers view labor no matter how many pointy headed “experts” in cubicles who’ve never signed a paycheck say there is. Business has always strived to keep costs as low as possible. That’s responsible management and always has been. Nothing new. But as technology advances the ability to do more with fewer humans continues to accelerate. Does this support the author’s conclusion that technology is part of the “problem?” NO! All that technology has to be designed, manufactured, distributed, sold and maintained by somebody. Are you going to try to tell us that the advent and rise of the PC a la Microsoft Windows™ cost people jobs? If so, please regard yourself as an expert and stop speaking.

“Conthider theeth clueth”

A truly “thoughtful” paragraph. May we reiterate; THERE IS NO SUCH THING AS A JOBLESS RECOVERY!! You certainly can’t call it the norm. I don’t know if our author just doesn’t know how to read a simple graph or was relying on “experts” who don’t know how to read a simple graph.

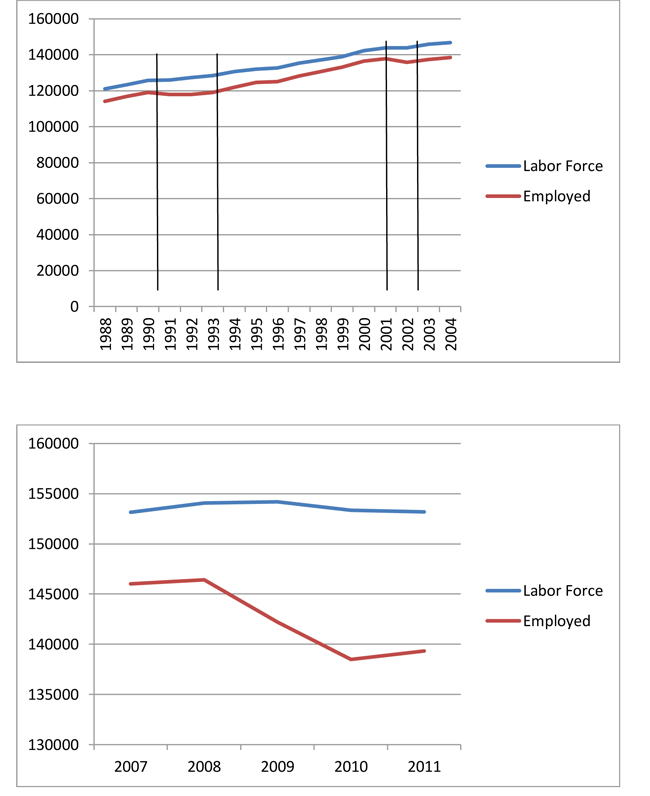

Here are the official stats from the Bureau of Labor Statistics (www.bls.gov)

Jobless recoveries are the norm? Do the ’91 and ’01 recession/recovery cycles look jobless to you? They don’t to us, either. The only divergence we see is occurring right now and is in large part due to the fact that most cyclical recessionary periods last eighteen to twenty-four months. We are moving deeper into uncharted territory every day with no indication of policy change on the horizon. That will perpetuate the pain.

When will these guys understand that companies do not hire to be nice and fire to be mean? Good executives manage the size of the workforce based on demand. Managers who don’t have companies that go out of business. Managers of yesterday did not keep “unneeded” workers. A lack of technology required they keep a higher percentage of people. Even then, as now, however, necessity is the mother of invention. A firm’s first priority is to survive. Remaining employees become committed to keeping their jobs by enhancing the survival prospects of the company. They innovate, experiment and execute on new ideas that increase efficiency during and beyond the recession. Does that mean certain “jobs” won’t be recalled. Yes. But if the company is more efficient in the face of rising demand new positions will automatically be created which, of course, leads to growth which leads to new hires with different job descriptions. As to why layoffs were faster this time; data analysis continues to accelerate in speed, sophistication and accuracy. The downturn started as then-Senator Obama became the clear frontrunner in 2007. The policy priorities of his administration were obvious to those who invest real money and hire real workers before the election. In other words, businesses could see it coming sooner than in the past and reacted appropriately.

“Experts” Groshen and Potter tell us when layoffs are permanent recovery is slower. They get paid to elucidate these nuggets of truth. No kidding! But the idea that it’s because it takes time to review resumes is silly. They talk of the evils of part-time and temps? When things improve for real who do they think are the first candidates for conversion to full-time employment? Could it be the temps already trained and experienced? Resumes are the bottleneck to recover? C’mon!

Yes, responsible executives care about stock price. They have to answer to the owners of the company, public or private. Why the authors paint this as a negative is beyond me. An even bigger mystery is how he can suggest that flexibility and stability are competing priorities. A company that can’t be flexible can’t achieve stability. Stability is never a guaranteed constant without a commitment to flexibility. Flexibility is the currency that buys stability. Just ask Borders and Blockbuster. They continued to operate with 1980’s and 1990’s business models. Their lack of flexibility lead to fatal instability.

We could go on for pages about the apparent confusion as to why a company may choose to hire overseas but we think our readers get it. We do, however, have to comment on the idea that China’s increasing wages of up to 17% of U.S. wages by 2015 will spark a mass exodus back to the U.S. We may start to see some movement in that direction but only an “expert” or one who relies on “experts” could think that a delta of 83% is insignificant when making payroll.

As to the yadda yadda on difficulty hiring adequate workers, does anyone believe the sentiment “ya just can’t find good help these days” is new?

At the end of the day small business is the true driver of jobs in the U.S. That’s why the notion of “too big to fail” is a travesty. Had those companies been allowed to meet their appropriate fate it would have created untold new opportunity for talented people to start over and do it better than before in businesses of every size. As it is policy has created uncertainty, fear, terrible unemployment and a solid hesitation to start new businesses or invest in the growth of existing ones and there is no end in sight.

We don’t know how else to say it, folks. Policy matters.

Thanks for reading and…stay tuned.

© Blue World Asset Managers August 2011