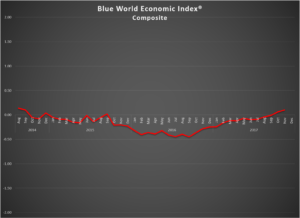

Blue World Economic Index®

Scale: -2 to +2

Release Date: Usually the Last or First Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Date 11/30/2017

Analysis

The BWEI® extended the winning streak and pushed higher into positive territory closing November 2017 at .1. There is still some hurricane influence in there, as some reports are a full two months lagging, but that doesn’t diminish the strength we see, and where hurricanes were still a factor our discretionary values remained largely unchanged.

We know Consumers are still in a good mood even without benefit of the weekly Bloomberg Consumer Comfort report, which didn’t post the last two weeks. That won’t have a material impact on that category. Not surprisingly the Las Vegas Strip Revenues suffered in October, but are holding on to a slight gain for fiscal YTD. Retail slipped fractionally, but that was expected as the hurricane blips wash through. GDP caused an optimistic stir, posting better than 3%. We are as pleased as anyone to see it, but any time inventories make a material contribution we have to be cautious because it’s a while before we see if the build is paced/justified by sales. At this point, the majority of reports lean in the right direction.

Will there be a rate hike? We’re afraid so. This appears to be a Fed looking for any excuse to move rates. For example, they will likely focus on the PCE and Personal Income headlines in today’s Personal Income and Outlays report showing a move in PCE and a bump to income. The detail, however, shows the PCE move to be tiny, and the income increase coming from interest income, while wages and salaries were on the soft side. We just don’t see enough consistency across the six reports followed in the Inflation category to warrant such hawkish policy.

The Numbers

Of the eight major categories, five are positive, three negative, and no break-evens this month. In spite of the hoopla, Employment and Inflation remain stubbornly negative at -.23 and -.26 respectively, with Services flat to October at -.11 but showing some signs of life. Consumer, General Measures, Manufacturing, Real Estate, and Retail are all comfortably in the black with retail being the only one of the plus group to lose any ground, which was explained above. Manufacturing is beyond belief (almost literally), as that category composite sits at a pack-leading .49, where the Fed sub-group is at 1, and the non-fed group is up to .41 with improvements of .05 and .06 respectively from October readings. We hope to see additional corroboration in the Employment Situation report due out next Friday the 8th.

Is the market overheated? Yes. But that’s been true for five years. Our strategy is to have appropriate safety nets strung and keep riding the wave. If you’d like some thoughts on that, give us a shout. Other than that, see you next week for the Blue World Jobs Report Analysis!

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release sites should be cross referenced. The index assignments represent the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on the index.