Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Brain Surgery is not Rocket Science to a Brain Surgeon©

Date: December 7, 2018

Aren’t expectations incredible? We see the “experts” announcing the economy is losing steam because headline jobs numbers missed by 43K!! FUUGEDABOUDIT!

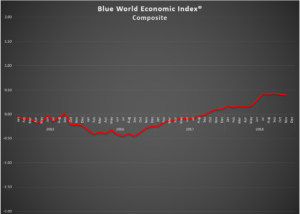

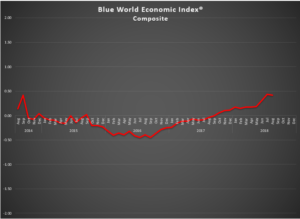

The economy is alive and well and that includes the jobs market. True, real estate is having some trouble but that has more to do with ill-advised Fed policy that may be slowed by this and some other data, but other than that the Blue World Economic Index® for November shows solid performance.

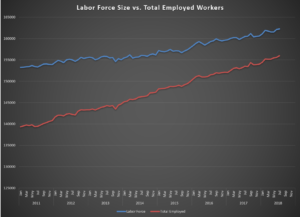

Headline total was 155K but the Private Sector added 161K. The Labor Force and Total Employed grew. Total Unemployed was down and Not in Labor Force was essentially flat. The diffusion Indexes are still very high with the Total Private Sector at 58 and the 76 Manufacturing Industries just shy of 64! There was a net down revision to the last two months but not enough to overcome the prior. Wage growth is still sluggish, but we expect it to catch up eventually, probably by Q2 2019.

Things are moving steady and strong. A little restraint from the Fed should feed Real Estate and don’t worry about trade wars. It may take a while to change learned behavior but they can’t hold out against the US for long.

Have a Merry Christmas and Happy New Year. We’ll wrap up 2018 on Friday, January 4th with the release of the December jobs numbers.

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, December 07, 2018