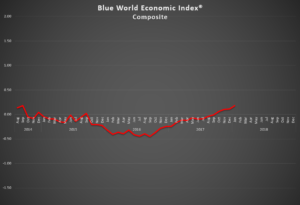

Blue World Economic Index®

Scale: -2 to +2

Release Date: Usually the Last or First Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Date: January 31, 2018

Analysis

What else can be said? The economy is on the move. The BWEI® made a material move to the North this month, and much of that was based on quarterly reviews of the twelve and twenty-four month trends which are more heavily weighted when calculating the index value. An upgrade of the ADP 1-year trend from -.5 to .5 was particularly impactful. Within the Consumer Major Category, the TD Ameritrade IMX demanded trend upgrades as did Investor Confidence, while the Bloomberg Consumer Comfort Index set a monthly average record high.

We continue to feel the momentum is real but fragile and subject to political, economic, and policy risk, not the least of which is an apparent bias toward prophylactic rate increases in anticipation of inflation. The Hawks need to stand down for a while and let this thing develop. Uncertainty about the outcome of investigations is causing hesitancy as the world frets about whether the guy whose policies sparked the move will make it through a full term.

There was a great deal of anticipation regarding the Employment Cost Index report that came out Wednesday morning, but we don’t know why. This is a quarterly report which won’t take the effects of the post-tax reform wage increases into effect until Q2 of 2018. In spite of that, one can hallucinate a slightly positive trend developing already. Matt talked about the impact of tax reform on WBBM’s Noon Business Hour in Chicago on January 11th. You can follow the link, scroll down to the 11th and Matt starts at 2:20 into the podcast.

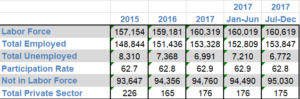

The Numbers

The index advanced .06 to .18 (rounded) from .11. That ties the all-time record high set in September of 2014.

Employment, Inflation and Services remain painted in red ink where Employment showed material improvement, Inflation retreated fractionally, and Services were still stubbornly unchanged. Consumer, General Measures, Manufacturing, Retail, and Real Estate are positive where all padded their leads except Manufacturing and Retail, which showed fractional slips. The Manufacturing pullback was actually welcome as the Fed sub-group surveys came back down to solid yet sustainable levels of strength.

ADP was huge Wednesday morning. Let’s see if it translates to the BLS out this Friday the 2nd of February. The Blue World Jobs Report Analysis will be out before noon Friday. See you there and have a great month!

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release sites should be cross referenced. The index assignments represent the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on the index.

©Blue World Asset Managers, LTD Wednesday, January 31, 2018