Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Impact: VERY HIGH

Management Value: CRITICAL

Friday, January 08, 2016

Brain Surgery is not Rocket Science to a Brain Surgeon©

Conspiracy? No. Cynical? We’ll get back to ya.

292k net hires and 275k of them in the private sector, just where we want to see ‘em. Not in Labor Force and total Unemployed are down, and the size of the labor force is up. These are many of the things Blue World watches intently to take the true temperature of the labor situation, and they are all very encouraging. Then it gets a little weird. We have seen much smaller numbers move the Unemployment Rate very dramatically and the same for the Participation Rate. Here we see just a .1 move for participation and the unemployment rate was unchanged. Strange days indeed. Wages moved backward slightly, hours were again flat, and the diffusion indexes moved in the right direction.

As usual, service providing industries were the big winners accounting for 230k of the net 275k private sector hires. Usually we deem this area too deep in the weeds to publish, but it is worth pointing out this month because the PMI Services and ISM Non-Manufacturing surveys both reported negative results with hints at slowing hiring. The regional Fed manufacturing reports have been in the red for quite some time.

While we are not conspiracy theorists, we are proud skeptics and even prouder cynics. Therefore, we must include all of our observations in these analyses, because the information is just too critical to making informed management decisions. The unfortunate truth is that the jobs and some other high-profile reports have been politicized in the last several years. Fortunately, the shenanigans occur at the headlines, leaving the Devil safely ensconced in the details.

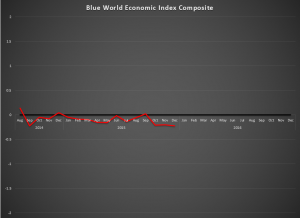

The majority of the data from 2015 screams economic stagnation to slowdown. In fact, the Blue World Economic Index™ spent all but one month in negative territory, with the annual average coming in at -.11. Without going totally wonk, suffice to say that some important information in today’s report exhibits noticeable departures from detail in other reports to a degree that is out of character. We must also now be concerned with who is getting these jobs. There is building evidence that a disproportionate number of illegal aliens are getting many of the new jobs, and that could have a material impact on the math applied to legal citizens counted in the reports.

Overall, we won’t look a gift horse in the mouth. Let’s hope (we hate that word relative to business and economics) that a positive trend can take hold from these last two reports. Will we advise clients to open the checkbook and start pushing expansion based on that hope? No. Why not? Because:

We just got an ill-advised rate hike which now needs some really good PR and pronto, U.S. manufacturing continues to hemorrhage, commodities are suffering a historic rout, deflation is a constant companion, the dollar is too strong, our markets are tanking, China is burning, North Korea detonated an A bomb, Iran is ignoring our nuke deal, ISIS is everywhere, Al Qaeda is staging a comeback, threats are pouring over the borders of every significant world economic power and, oh yeah, the biggest motivation to fudge, IT’S AN ELECTION YEAR.

Conspiracy? No. Cynical? ABSOLUTELY!

Have a happy, safe, and prosperous New Year and, as always, thanks for reading and, please, stay tuned…

Release Site: www.bls.gov