Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Friday June 2, 2017

Brain Surgery is not Rocket Science to a Brain Surgeon©

FOUL!

Wow, it looks bad. Usually the issues are confined to the headline, but the filth filters right through to the cave floor this time. It is hard to imagine a report that diverges more radically from every other employment measure over the last month. We’ve seen the report become politicized and lose some of its validity at the headlines, like the Unemployment Rate, but usually the details paint a different picture. Not this time.

The only two positives were the number reporting as “Unemployed.” That total fell by 195k. The other was the Private Sector total which tallied 147k, 9k higher than the headline of 138k because the government shed 9k for May. That’s some perspective on how bad this report is, 147k for the Private Sector counts as “good” news!

The balance of the Blue World key indicators including Labor Force size, Participation Rate, total Employed, and Not in Labor Force moved the wrong direction and in almost implausible magnitudes. This will likely have an impact on the Labor Market Conditions Index, which updated and revised to the North at the beginning of last month. We released an update based on that, and we will do so again next week if warranted. Hours and wages are uninspiring.

This report coupled with the inflation reports of the past month should assure a current victory for the doves at the Fed, so don’t look for any additional rate hikes coming out of the next FOMC meeting.

What does it mean for the direction of the economy? There are so many balls in the air, Russian ties, Paris Accord, Travel Ban litigation, to name just a few headliners. The ones not getting a lot of play are the regulation roll-backs occurring. If you’re wondering why the markets continue to run in all this turmoil and uncertainty we can look there. Congress hasn’t gotten much done, but restrictions and burdens on business are being reduced at a very brisk clip. If anyone in a position to impact that process is listening, we need to add the Fiduciary Rule to the list of evils that need to be vanquished.

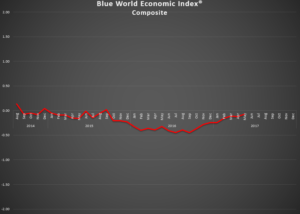

Here is a link to our first ever podcast for the Blue World Economic Index® report released yesterday. It, also, has some interesting findings, including on employment.

Matt will be live discussing some investment ideas and market conditions on CBS Chicago’s “Noon Business Hour”, AM780 and 105.9FM, on Monday at about 12:50p Central.

Interesting times, indeed. We’ll keep an eye on it and report back here next month!

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, June 02, 2017