Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Date: August 3, 2018

Brain Surgery is not Rocket Science to a Brain Surgeon©

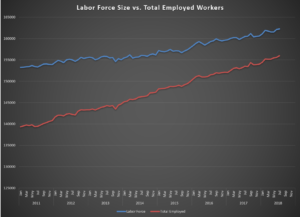

Job growth for the private sector continues to advance at an impressive pace. Even though the headline says 157k, the Private Sector grew by 170k as government got smaller by 13k payrolls. Add to that upward revisions to May and June of 59k and we’ve got a really hot labor market! Today’s graph is the Size of the Labor Force vs. Total Employed Workers, and it shows a decidedly expansionary pattern. Review this and our post “A Flute with No Holes is Not a Flute and a Recovery with No Jobs is not a Recovery” from 2012, and you’ll get a very good visual comparison.

The Labor Force grew by 105k, Total Employed grew by 389k and Total Unemployed fell by 284k. The Participation Rate remains stubbornly below 63% at 62.9%, but the Diffusion Indexes show expansion in all private sector industries, including manufacturing, and not by a little. Remember, 50 is a break even on expansion. Both of these are holding in the mid-60’s.

The bellwether sectors of Manufacturing and Construction had another winning month, and part time workers for non-economic reasons are being hired at a break-neck pace (228k) in a mad dash to satisfy backlogs. The importance of that cannot be overstated.

Wages grew, but probably not enough to spook the hawks. That’s good. We still don’t believe inflation is a realistic threat to the expansion right now, and prophylactic moves to “head it off” are ill advised.

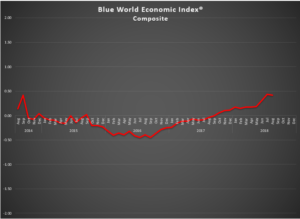

The jobs report is corroborated by the balance of economic reporting over the past month, including GDP. You can get a broader look at the economy at the Blue World Economic Index® report which posted earlier this week.

So far, so good in 2018. Expansion is the name of the game. Go for it with the right hand, but always keep the left hand near the brake with a watchful eye on the economy through us!

Matt is on real time today at 12:05p C on WBBM in Chicago to break it down live on the Noon Business Hour, AM780/105.9FM. If you miss it live you can get the Podcast later today.

The next jobs report is scheduled for September 7th. We’ll see you then. Have a great August!

As always, thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, August 03, 2018