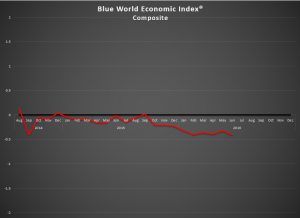

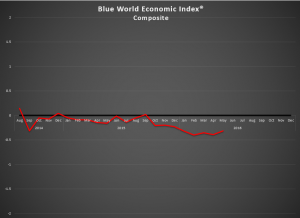

Blue World Economic Index®

Scale: -2 to +2

Release Date: Usually the Last or First Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Release Site: www.blueworldassetmanagers.com

Thursday, June 30, 2016

According to the Blue World Economic Index®, June 2016 was NOT a good month for the economy. The index slipped from -.32 to -.41 and not only were the monthly readings weak, but a quarterly review of the recent and longer term trends yielded some downgrades. With half of 2016 in the books the Index average is materially lower than the average for 2015 running .26 lower at -.37.

Seven out of eight major categories were negative this month (welcoming another category to the red ink congregation) with Employment and Manufacturing continuing to be the weakest areas. Real Estate was the only positive category but even it lost ground from May to June 2016. The Consumer category saw an improvement but still could not achieve black ink status.

Without the full impact of Brexit or any hint of significant policy change on the horizon, our outlook regarding material improvement to the BWEI® is rather grim.

Watch for the Blue World Jobs Report Analysis out next Friday the 8th and Matt will be analyzing it live on CBS Chicago’s Noon Business Hour at 12:09pm central at WBBM AM780 and 105.9FM.

Have a wonderful and safe 4th!