Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Date: September 7, 2018

Brain Surgery is not Rocket Science to a Brain Surgeon©

Revisions and wages command the attention from the August jobs report. The headline is 201k while the private sector added 204k as government got smaller again. This is a solid report, but it did cool from the unsustainable pace set by the last several months. The key areas of Labor Force size, Participation Rate, Total Employed and Not in Labor Force totals lost a little ground. That coupled with a net 50k in downward revisions to the prior two months shows a bit of a return to earth, at least for August, but this data in no way suggests any slowing in the economy at large.

The number of those at work part-time for economic reasons is way down again and those part-timers for non-economic reasons is up again. The Diffusion Indexes are still over 50 even with a drop off in manufacturing jobs, and the Private Sector totals are still averaging over 200k for the year in spite of the oversized downward revisions.

The big news, however, comes from wages. Last month on WBBM’s Noon Business Hour Matt was asked about wage pressure if we are indeed near full employment. He predicted it should start to show up soon, and here it is! At .4 and 2.9 percent month over month and year on year, respectively, these handily beat estimates, and we can already hear the hawks’ wings beating the air. It will be difficult for the Fed to keep their fingers off the volume, so we see a good chance of another hike at the next meeting.

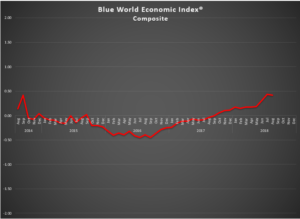

The Blue World Economic Index® posted earlier this week and we’ll see you back here at the end of the month. Have a great September 2018.

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, September 07, 2018