Blue World Economic Index®

Scale: -2 to +2

Release Date: Usually the Last or First Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Date: April 30, 2018

Analysis

Wait-and-see is the frustratingly common theme for the economy. The BWEI® for April’s report held strong and unchanged, but the ground beneath our feet still feels unsteady as lawyer’s files get seized, tariffs get implemented, porn stars get credibility, and investigators seek urine-soaked beds in Russian hotels… WOW!

There were a lot of conflicting signals this month, most notably from GDP, durables, and wages. The Employment Cost Index, a quarterly report, flagged wage pressure but that was not corroborated in the Personal Income and Outlays report, which issues monthly. The BLS jobs report Friday will probably break the tie and either feed the hawks or stroke the doves at next week’s FOMC meeting, as the most watched inflation measure tickles the target of 2%. Spending strength in the current GDP report was offset by a down revision to February, and weakness was in key areas like computers and machinery. The only substantial agreement this month was with regard to strength in spending on services.

Strength is still very evident in many of the off-the-beaten-path reports like the Cass Freight Index which has shown steady and impressive results.

The Numbers

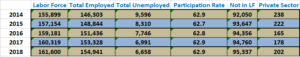

The index held at .17 where, except for Employment which fell back .11, all gains and losses were fractional. Employment and Inflation are the only two of the eight major categories in the red, and Consumer metrics are still far and away the leaders at a Category Composite of .51. For comparison, second place is Manufacturing at .44.

The Blue World Jobs Report Analysis will be out Friday morning. See you there! Have a great May. Hopefully it will only snow once in Chicago this month..!

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release sites should be cross referenced. The index assignments represent the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on the index.

©Blue World Asset Managers, LTD Monday, April 30, 2018