Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Impact: VERY HIGH

Management Value: CRITICAL

Monday, December 07, 2015

Brain Surgery is not Rocket Science to a Brain Surgeon©

Important Update to the Blue World Jobs Report Analysis

When assessing the health of the labor market the Fed knows what we know…the BLS report headlines have been rendered useless. So the Fed directed their research department to give them a better yard stick to measure the jobs market. What they got was the Labor Market Conditions Index.

The Fed created this index to get a better handle on the true state of the labor market. You may wonder why they would feel the need for a new index when we have the Employment Situation Report. The answer shows how far ahead of the curve Blue World is! This report is “unofficial,” yet gets lots of attention from the Fed because they realize what Blue World’s reports have been saying for years; the unemployment rate is artificially low! Wouldn’t ya know that the detail the Fed research department looks at to create this index very closely matches the Blue World analysis! (High 5 us!) They did a lot of work for nothing…they should have just been reading us!

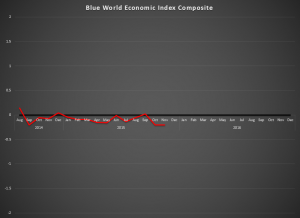

Note from the graph that in 2012 the index was near 12, and there was no serious talk of a rate hike then. The index has plummeted since, only recovering to about 8 in the succeeding years, and averaging only 1.4 for all of 2015 with two consecutive months below zero. Even the highly touted, monstrous report from October with its upward revision was only able to move the index from 1.6 to 2.2.

This is why dovish Fed principals are saying it is not time for a rate hike yet. They’re right! The problem is that the pressure is making it harder and harder for them to resist. We hope they can hold out.

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Monday, December 07, 2015