Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Sensitivity: VERY HIGH

Management Value: VERY HIGH

Friday, May 06, 2011

Brain surgery is not rocket science to a brain surgeon

Extra, Extra, Read all about it: Jobs Report Surprises Experts!!!

An ugly duckling with no swan in sight.

I hate to rain on the “expert’s” parade but the jobs report is not good, it is not mixed and it is NOT a surprise. The employment report is bad. Period. We predicted Wall Street would get past the headlines and into the detail shortly after lunch. They did.

An optimistic estimate is that about 1.5 million jobs have been added over the last year or so. Conservatively, that puts us about 7.5 million jobs behind where we were before the crash. This is not a recovery profile. It is the (predictable, mind you) profile of an economy bouncing along the bottom waiting for something to send it toward the surface. Unfortunately, there continues to be no catalyst for any bump in demand and, therefore, no reason to hire at the rate required to improve the overall picture. On the contrary, some of the problems we’ve been saying were laying in the weeds for the last year are starting to poke their heads up and make some noise loud enough for even the “experts” to hear. Most notably, of course, is inflation. If things cost more to make and more to transport eventually they’ll cost more to buy. The cost of food and fuel, you know the stuff that the “‘experts” say we shouldn’t count in inflation, will drive the cost of everything sooner or later. For us it’s sooner but even the “experts” seem to be catching on, lately. But there’s a double whammy. Just to make sure inflation has a friendly environment to thrive in the Fed (big collection of “experts”) decided to buy some debt (effectively borrow money from itself) with printed money. That’s important; not money created by increased GDP and productivity. It was new money essentially photocopied to buy loans made to us by us. That dilutes the value of a dollar so, by default, it takes more of them to buy things = inflating prices. The en vogue, sexy term is “Quantitative Easing”. When inflation didn’t kick up fast enough they decided to do it again. This time they gave it an even catchier moniker: “QE2”. We’ll just call it “dumb and dumber.”

To the numbers, then…

We added 244 thousand paychecks and the unemployment rate went up to 9.0%. This is the volatile labor force size phenomenon we have been describing for the last few months.

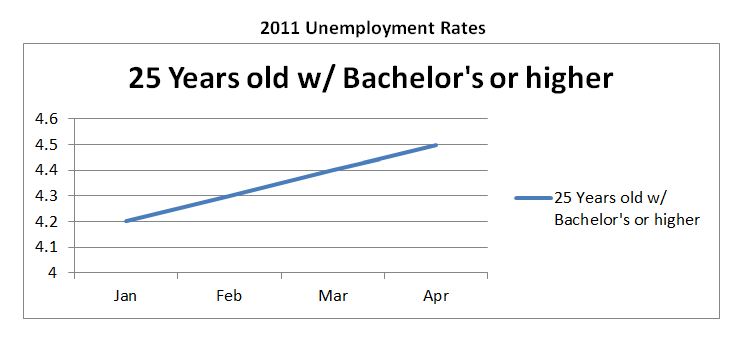

Most of you know our MVS (Most Valuable Stat) is the unemployed rate for those 25 years old and older with a 4-year college degree, or higher. Their unemployment rate for April was 4.5%. That’s bad enough. The 2011 trend is very unsettling.

There were 244 thousand private sector jobs added but the number of persons unemployed for less than five weeks rose by 242 thousand. Those are new job losses. That is an ominous sign, especially in light of the current “slow-down.”

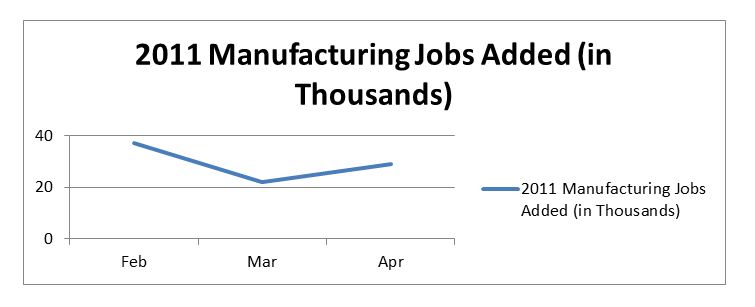

The number of people working part time because they could not find full time employment increased and the number of marginally attached and discouraged workers (leaving the labor force) is on the rise, again. Total weekly hours worked and overtime in manufacturing, both indicators of demand, fell slightly even though there is some pant-wetting over modest payroll increases. This month’s increases follow a recent pattern that is grossly flat.

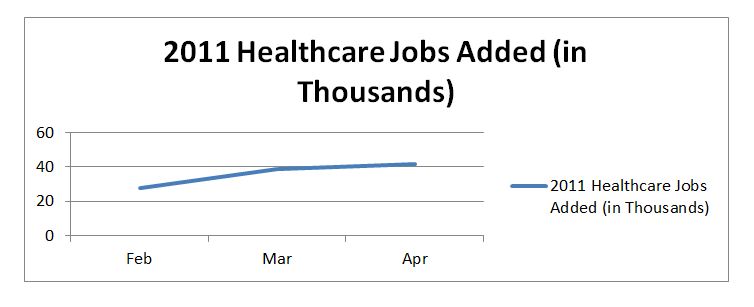

While the Establishment Survey has some bizarre looking spikes and dips, hospitality, retail, and healthcare showed the strongest gains. Of those healthcare is the only segment that demonstrates a stable positive trend in hiring although the monthly gains are uninspiring at just fiver figures.

There are several more numbers that help round out the same story. For a closer look please follow the link at the top or bottom of the page to the official BLS release site. In the mean time we say keep that defense on the field of investing whether that field is buying stock, hiring employees or anything else that real people who invest real money do. We’ll be content to let the “experts” continue theorizing from their cubicles and getting surprised when real data generated by the rest of us inconveniences their brilliance!

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.