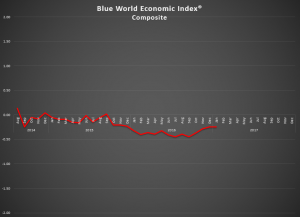

Blue World Economic Index®

Scale: -2 to +2

Release Date: Usually the Last or First Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Tuesday, February 28, 2017

The index is on the move…but still betting on the come! Overall, the composite improved by .08, moving from -.25 to -.16, a healthy jump. Six of the eight major categories are still running in the negative, but six of the eight also improved in February.

From a hundred thousand feet conditions appear to be improving, but the charge is clearly being led by the surveys of anticipation as opposed to the hard data. Is that ok? Of course! As we’ve said, no optimism, no recovery. But the delta is rather striking and nowhere more than in Manufacturing. That category follows twelve reports each month. Six of them make up the Regional Fed Manufacturing Districts sub-group survey reports. The hard manufacturing data actually slipped in February, but the Fed sub-group jumped by .17 to post a +.2! That says managers are optimistic that things are going to pick up rather quickly. Let’s hope it develops that way.

Policy matters, and in fact, anticipation of policy matters. The prospective changes that are being advertised have the general business community and the consumer in a very giddy mood, but we caution it is still just a good mood driven by optimism, so be excited, but don’t bet the farm until the hard data establishes a verifiable trend. The way it’s looking, we still believe that could show early signs before year end.

The Employment Situation Report is scheduled for release on Friday, March 10. That may delay The Blue World Jobs Report Analysis until Monday the 13th, but if that’s the case it will incorporate the Labor Market Conditions Index analysis so there will be a little more meat on the bone.

Have a great month!

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release sites should be cross referenced. The index assignments represent the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on the index.

©Blue World Asset Managers, LTD Tuesday, February 28, 2017