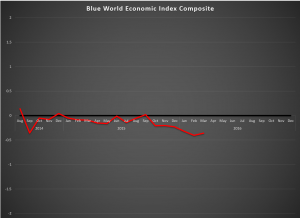

Blue World Economic Index™

Scale: -2 to +2

Release Date: Usually the first Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Thursday, March 31, 2016

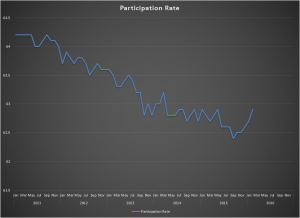

The BWEI posted a fractional gain of .05, improving from -.40 to -.35 for March 2016 which, obviously, only means less negative. Of the eight major sectors, six remain in negative territory. Those include General Measures, Employment, Inflation, Retail, and Services. There was notable improvement in Manufacturing, which interrupted its recent freefall improving .15 from -.82 to -.67. Difficulty in Retail was corroborated by the Challenger Job Cut report this morning showing the retail sector leading the way in announced mass layoffs, overtaking the energy sector for the month, but the real Retail demon in the dark has been the monthly Inventories reports showing a chilling trend in the I/S ratio. Anyone who constitutes a link anywhere in the supply chain would do well to review the most recent six to twelve releases.

The two sectors remaining positive were Consumer Measures and Real Estate. However, the Consumer total lost ground, and Real Estate remained flat at .10 after a very mixed month where five out of the nine followed reports averaged in at negative values.

What’s the Fed going to do? We say nothing. If you’re listening closely you’ll hear the word “recession” creeping into the media, but you’re not unprepared if you’ve been following us and that’s the point of our existence!

Don’t miss the Blue World Jobs Report Analysis out tomorrow morning, and Matt will be discussing it live on WBBM AM780 and 105.9FM in Chicago at 12:09CST. Those outside of market can find the podcast at CBS Chicago later in the day.

Have a prosperous April and thanks for reading!