Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Friday, January 06, 2017

Brain Surgery is not Rocket Science to a Brain Surgeon©

Those who don’t know their history are doomed to repeat it. Remember, our reports are written to provide real managers who manage real businesses and employ real people with actionable intelligence for strategic planning. We are not spin-meisters for the public markets, any one industry, or any political party or philosophy. We don’t care what works as long as it works. Policy matters, and this policy didn’t work.

The employment report is, in many ways, both a leading and lagging indicator depending on the data viewed and the perspective sought. We must continue to caution against forward-looking reads of this or any of the economic releases for several months as we anticipate significant policy change in the next year. That would not be true had the election gone differently. It will take a while for policy change to impact the data and show up in the reports in such a way as to return to a prospective strategic planning application. The value, of course, is to analyze from a lagging perspective so as to understand policies that have proven ineffective and avoid repeating them in the future.

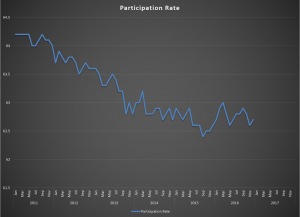

2016 was dismal from an employment point of view. Surprised to hear it? Not if you read us every month! This report was weak and predictably so, as we’ve had plenty of time for the current policies to establish their effect. The headline shows 156K new hires, but the Private Sector only added 144K. Some “experts” are excusing the December 2016 numbers as there were upward revisions to the prior two months closing the gap on the estimate miss. The problem is that even with the revisions the private sector is still below 200K. With 2016 fully in the books, the sad numbers are that the average payroll gains in the private sector were only 166K. That is far and away the worst monthly average of the second term of the outgoing administration. The Participation Rate is still below 63% and has averaged there all year. That’s the chart this month. The Not in Labor Force statistic is above 95M for a second straight month. Because of those two statistics the fraudulent unemployment rate is, well, fraudulent so who cares.

Remember, there is NO CRIME IN BEING WRONG! The crime is committed when managers fail to acknowledge that policy is not producing the intended result and refuses to make adjustments. This is true whether we’re running a lemonade stand, a multi-national corporation, or an entire country! Do we know if the new policies will work? No. We just know these don’t, and that’s all the reason needed to discontinue and try a different approach. We hope the new administration will be mature enough to change course if they find themselves underperforming economic expectation.

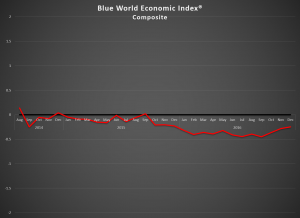

The Blue World Economic Index® for December and year-end wrap is up. January 2017’s BWEI® will be out at month’s end. See you then. Happy New Year and have a great January!

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, January 06, 2017