Employment Situation Summary

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Relevance: VERY HIGH

Management Value: VERY HIGH

Brain surgery is not rocket science to a brain surgeon.©

Friday, August 05, 2011

Blue World Employment Situation Analysis

We say this analysis is not about headlines and spin. Sometimes it’s an easy thing to write and sometimes painful. Like today. The details of the report do not support the notion that the labor market is improving. On the contrary. The idea that it’s good to have 117k new jobs vs. an expected 75k in and of itself is an indication that things are bad. In truth, the size of the civilian work force got smaller, the participation rate fell, the number of employed people fell and the number of people not in the labor force rose. All this combines to produce an unemployment rate that is flat but will be touted as an improvement by many. GDP was poor and revised down, mass layoffs have been in the news in that last week and on the rise, consumer confidence and CEO confidence is down, earnings are very mixed and outlooks are weakening. All of the indicators affirm the lack of recovery and we have an economy still on the ropes.

The markets opened with the predictable knee-jerk but at the time of writing exuberance is waning as the details of the report make their way into the collective awareness.

Some Numbers:

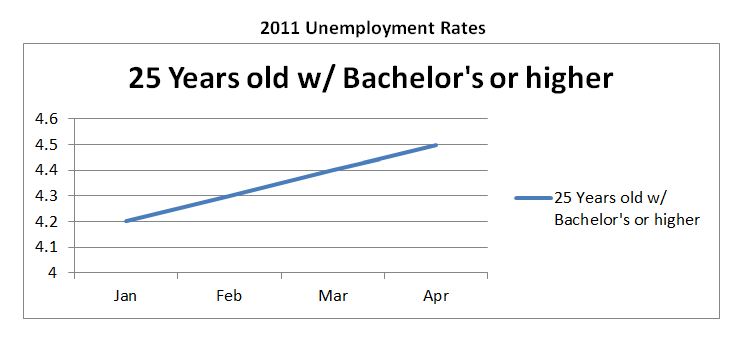

25+ with a bachelors and higher is still above 4%, and those working part-time for lack of full-time availability is up. Average hours worked and overtime in manufacturing was flat at 41.4 and 4.1 hours per week, respectively.

As we continue to observe, policy matters.

We remain in a very defensive posture with our investment strategies and will for the foreseeable future.

Thank you for reading and…stay tuned!

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced for accuracy and footnoting. The analysis represents the opinion of Blue World Asset Managers, Ltd. who are not giving advice and does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers August 2011