Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Sensitivity: VERY HIGH

Management Value: VERY HIGH

Friday, April 03, 2015

Brain surgery is not rocket science to a brain surgeon©

WOW, this is bad. Not unexpectedly bad unless you happen to be an “expert.” We continue to point out how bad the labor market is, and we know that is in stark contrast to what we see in the headlines. This was borne out by a friend who said he reads our reports, but they make him angry. (Thanks for reading and for the input, Mike.) We write these to try and provide managers, business owners and investors with additional actionable intelligence for decision making, as opposed to steering perception so we calls ‘em like we sees ‘em…and what we see is erosion, not “recovery.”

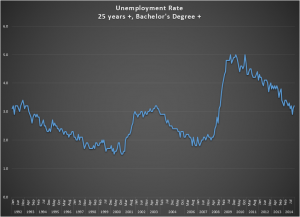

We base our analysis on the numbers and trends, so let’s get to it. We’ve been saying that the number of new jobs created and the unemployment rate no longer matter because the labor force is stagnant. March of 2015 is no exception. The net gain to the private sector was 129k, well below expectation but again, that’s not the news. The real news is that the labor force shrank by another 100k, the Not in Labor Force number grew over a quarter million, and the Participation Rate tied its “recovery” …low?!? Oxymoronic? Yes. Sad and true? Yes.

There was some even more disturbing data in the deep end of the pool. First, those working part time due to slack work conditions grew by over 200k, and second was “news” from the manufacturing sector. News is in quotes because it is only “news” if we don’t follow the monthly regional fed manufacturing activity reports. Fortunately we do. The jobs report includes a diffusion index for the manufacturing sector. A diffusion index is very simple to interpret, because a number above 50 indicates expansion and below 50 shows contraction. The March 2015 diffusion index in manufacturing came in at 47.5. That is bad enough but it becomes virtually catastrophic when we see that February 2015 was 61.3 and a year ago it was 57.5. The number validates what we’ve seen come out of the regional Fed reports, which were red across the board for the internal Blue World Economic Index during March.

For those who invest real money, employ real people, and take real risks so that others may work, earn, learn, and grow we remain grateful and will always do what we can to help make decision making more informed. We feel we owe it to you. For now we continue to recommend you keep the defense on the field.

Happy Easter!

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, April 03, 2015