Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Impact: VERY HIGH

Management Value: CRITICAL

Friday, February 05, 2016

Brain Surgery is not Rocket Science to a Brain Surgeon©

An odd twist! Usually we have what appears to be a respectable number at the headline and much weaker indications in the detail. This month, and we can’t remember another, the opposite is true. We’re not saying the underlying is stellar. In fact it’s rather flat but compared to what we expected it was a pleasant surprise.

The headline says 151k. It’s actually 158k for the private sector, as the government shed 7k jobs in January. There was a slight uptick in the participation rate which, while still ridiculously low, is on a 2 month “winning streak.” The quotes are because we were deriding the number a year ago and this is .2 below that, but up is up! The labor force was essentially even, the number of those unemployed fell slightly, as did the number of those not in the labor force so all in all we’ll call it flat. After wincing at the headline this morning, we’ll take it.

Points of concern…

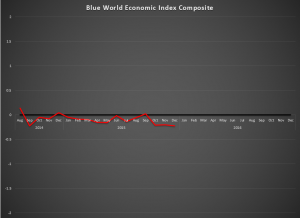

While the data was better than we expected, there is some concern over discrepancies with other reports out over the month. We won’t go through all of it but an example is manufacturing. The Blue World Economic Index™ was published on Monday of this week, and Manufacturing set a record low for the sector and the index at -.91. As of this morning it sits at -.98 and nothing points to any good news there, yet today’s job report shows healthy gains in all three subdivisions, durable, non-durable, and motor vehicle parts. Motor vehicle parts is the only one that makes any sense at all. So there are some things that don’t necessarily line up, but that happens occasionally, and they usually come back in line.

We keep fielding questions about the Fed, and we definitely feel they are suffering from “hiker’s remorse.” The markets are tanking, the economy is slowing, and there is a lot of talk of recession lately. All of that said we will, of course, monitor and evaluate month by month, but right now we’re pretty comfortable thinking there will be no further hikes in 2016. We certainly wouldn’t advise any, but they haven’t asked us…yet!

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov