Friday, April 27, 2012

Ignorance is curable. Stupid is forever.©

The Confusion Suffered by “Experts” II – GDP April, 2012

As our regular followers know we don’t usually do a post to analyze the GDP report in detail, because if we follow the monthly BLS Unemployment Report (www.bls.gov) the GDP is old news. All the data we need to predict GDP (at least to an accuracy of worse, flat, better) can be found in the jobs data. While today is no exception to the “no need to scrutinize” rule, we did feel a sense of obligation to comment on it due to the significant “unexpected” results reported today. As we talked about today’s release it became apparent that what we had was a sequel to our post The Confusion Suffered by “Experts” from August, 2011. It would be very helpful to review that post now so here’s the link. http://owl.li/ayFhe

Whenever we write experts in quotes you may assume we are saying the group or individual we are referring to is intellectually bankrupt (that means “moron”, “experts.”) Why do we exhibit such loathing for the “experts?” Because their financially or politically motivated spin analysis serves no useful purpose for those who invest real money, employ real people and are responsible for real performance. In fact, it can lead to conclusions and decisions that are dangerous to a business. And, of course, in some cases they’re just stupid.

So, why was the GDP report no surprise to us or our readers but was to so many “experts,” including the 85 economists (academics) polled by Bloomberg, for example? Because they don’t compare what they see in the data of one report to the data published in other reports and view the full body of information through the prism of real life. There was no defendable evidence that the GDP report was going to spike sharply or tank abruptly. We predicted a flat to shallow downward move from Q4 ’11 and that’s what we got. Kudos to those “experts” who also got it right.

The Confusion Suffered by Experts, referenced above, explains when and why some data releases lose their predictive value under certain macro conditions of the economy and, consequently, why it’s so silly to have wild market reactions to weekly data like first time unemployment insurance claims.

The Gross Domestic Product Report

We don’t need an in-depth tutorial on how to read the GDP report in order to follow this trail. All we need to know is that there are 4 marquee headings that contribute to overall Gross Domestic Product. They are:

- Personal Consumption Expenditures

- the total of what consumers spent

- consumer spending is 70% of our economy

- Gross Private Domestic Investment

- the total of what private sector businesses spend on fixed assets

- buildings, equipment, etc.

- Net Exports

- the net difference in value between what the U.S. sells and buys from other countries

- Since the 70’s the U.S. virtually always has a trade deficit and that subtracts from total GDP

- Government Spending

- total spent by federal, state and local governments

Remember, no single number, data point or report is valuable unto itself. Trends are what matter. Here are some examples of the trends that irrefutably predicted an uninspiring GDP report.

There have been three unemployment reports since the last GDP estimate. The key indicators that we can look at to get a sense of GDP are the following:

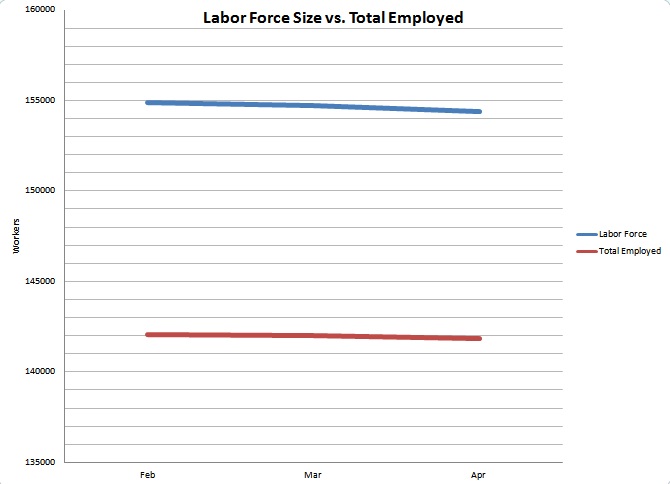

- Total unemployed population

- This is not the unemployment rate. The unemployment rate has been very misleading lately. See why at Why Does Blue World Keep Saying the Labor Market is not Improving http://owl.li/ayLvx

- The total unemployed rose in one month and fell in another. Coupled with a similar pattern in the total labor force size suggests an overall flat complexion so that would not predict an uptick in GDP

- Unemployment Rate of Workers who are 25yoa+ with a Bachelor’s Degree or Higher

- This group of professional, management, entrepreneurial and big ticket consumer types has been unemployed at rates never seen since records have been kept for nearly 3 years

- Expansion requires managers, entrepreneurs and big spenders. When the needle on this demographic is not trending to the right, GDP cannot advance aggressively.

- Avg. Hours Worked per Week in Manufacturing

- The number of hours worked in a week across the manufacturing sector is a major indicator of demand and, therefore, a great predictor of GDP.

- In the last three months the most optimistic read is a flat work-week length. This does not suggest GDP growth

- Avg. Overtime Hours Worked per Week in Manufacturing

- For corroboration and predictive analysis we review the need for Overtime Hours in manufacturing. Even if the work week length is flat, if overtime is trending up it’s a good bet companies will need to start hiring soon.

- Over the last several months O.T. hours in manufacturing have been completely flat and well below the number needed to presage the need for new workers. This does not support confidence in GDP growth prospects.

- Avg. Hours per Week in Construction

- Flat at best

- Need we go on?

Those are just a couple of examples of how one report can predict another report which is in stark contrast to the irresponsible reactions to shorter term output described in The Confusion Suffered by “Experts.”

Blue World has opined that recent increases in durable goods spending has been more about deferred expenditures than evidence of a true recovery. This hypothesis is supported by the durable goods orders report from yesterday (4-26-12) that showed a slowdown of consumer and business spending on items built to last at least three years. Blue World, therefore, expects a downward revision in that GDP category at the next estimate release on May 31, 2012.

The increase in consumer spending on non-durable goods (clothing, food, etc.) appears right in line with inflation so consumer spending is unimpressive and unconvincing.

Of particular note is the significant drop in business investment for the first quarter. This, too, signals prior quarter’s strength was more attributable to spending that had been put off during the worst of the recession and just couldn’t wait any longer.

Another line item that we watch closely is the Change in Private Inventories line. Inventories are goods that were produced but not sold. They can give pretty good clues about supply and demand. If inventories are striped out of the 2.2% GDP reported today the GDP growth drops to 1.6%. We’ll need to watch this over the next two Q1 estimates because the big drop from Q4 inventory’s contribution to the total GDP percent change could signal the deferred expenditure buying spree for consumers and business is over with the jobs data, manufacturing in particular, showing new finished inventory is not being replaced as fast.

Government spending continues to decline and for very understandable reasons. Remember, the government produces nothing. Taxes are a levy. They are not offered voluntarily in exchange for a product or service. When the private sector suffers government has no choice but to suffer as well because private sector success is government’s only source of revenue. This is why we keep yelling at the top of our lungs “POLICY MATTERS!!”

So, here ends the (first) sequel regarding the confusion suffered by experts. We would be very proud, flattered and humbled if we could say we have prevented even a single person from becoming an “expert.”

We could never adequately express our appreciation of you for talking the time to read our posts.

Thank you.

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, April 27, 2012