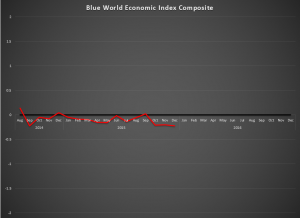

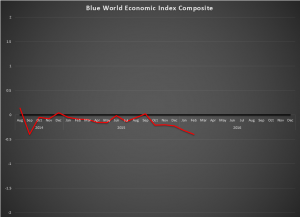

Blue World Economic Index™

Released Monday, February 29, 2016 for February 2016

February was not a good month for the U.S. economy according to the Blue World Economic Index™ composite, which settled at -.40 which is .08 lower than January. Of the eight major categories, six were negative including General, Employment, Inflation, Retail, Services, and Manufacturing. Real Estate broke dead even at 0.0, with Consumer measures remaining level and positive at .2. In spite of all that, there were a couple of late reporting bright spots that may hint at a better March. There were some notable conflicting data sets this month with Durable Goods and Industrial Production posting unexpectedly strong gains, which lifted Manufacturing to close the month fractionally higher than January even though it had fallen sharply at mid-month. Of the twelve Manufacturing reports the index follows, including the Regional Fed reports, they were two of only three positive readings. Let’s hope that starts a trend. Some authors have suggested that the Personal Income and Consumption data are in conflict between their individual readings and the GDP figures, which both posted Friday the 26th. We have to remember, however, that the GDP report reflects the 2nd revision to Q4 2015, meaning they are lagging while the Personal Income and Outlays report is current for January 2016. That said, the upward revision to GDP appears to be on the back of unwanted inventory build, and we’ve spent way too much time below 3%. Personal Income and Outlays, however, did hint strongly at optimism for a better March. Let’s hope that materializes.

Don’t miss the Blue World Jobs Report Analysis this Friday the 4th.