Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Date Monday, May 08, 2017

Brain Surgery is not Rocket Science to a Brain Surgeon©

Well, that’s a little better. The details are still weaker than we’d like to see, but last month’s train wreck does look like an outlier. While we thought there may be an upward revision to March, we saw the opposite as it moved from 98k to 79k. The Labor Market Conditions Index, as we expected, did show much stronger than the BLS headlines would have implied. So, what about April?

April looked much better at the top with the 211k. Slightly disappointing, however, is that the private sector remained below 200k at 194k. In spite of that and the mind-numbing March numbers, the Private Sector is already averaging 14k higher per month than 2016.

The Participation Rate is sub-63 with a very disappointing 162k returning to the Not in Labor Force group, BUT we may be able to start to hallucinate a flattening of that graph for the first time in many years. That’s the chart this month. Feel free to let us know if you see what we see. Total Employed and Total Unemployed both made solid moves in the right direction while the Total Private and Manufacturing diffusion indexes remain comfortably above 50. That is all wonderful to see.

Wages? Meh. The work week remains range-bound as does overtime in Manufacturing.

The Fed’s Labor Market Conditions Index won’t post until 10:00a Eastern, and we want to get this to press, so we will simply predict an improvement there as well. They do, after all, reject the “expert” analyses and read these things the way Blue World does…

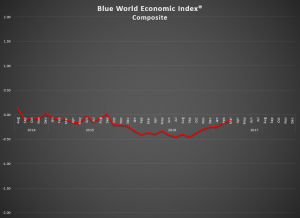

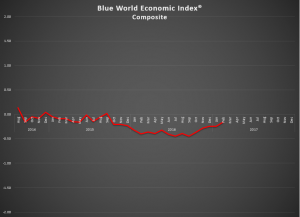

Have a great month and we’ll see you here at the back end with the Blue World Economic Index® summary.

As always, thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Sunday, May 07, 2017