Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Impact: VERY HIGH

Management Value: Critical

Friday, June 05, 2015

Brain surgery is not rocket science to a brain surgeon©

MIXED!!

Ok, perhaps a bit pathetic to express such exuberance over “mixed” but we have to give credit where it’s due. All the focus will be on the 280k jobs which is a solid post. The problems usually show up below the headlines, and this month is no exception, BUT some of the underlying data support the headline. We haven’t seen that in, well, years! So let’s have a look.

On the plus side…

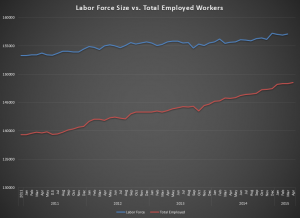

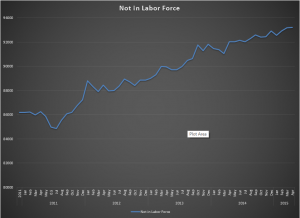

The headliner is 280k, but the important metric is the private sector tally which stands at 262k, 13k above the twelve month average. The civilian labor force grew, the total employed count rose, the number of those not in the labor force fell slightly below 93M, and private sector payrolls logged a solid gain. Folks, that’s a positive on four out of the first six metrics we use to analyze the report. That is a record for recent times.

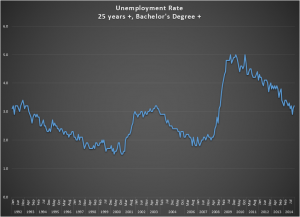

Some negatives? Yes. The fact that we got so many jobs with a corresponding increase to the unemployment rate is always a clue that something is amiss. The participation rate ticked up to 62.9, but so what? That is still hovering near “recovery” lows. The total number of those reporting they are unemployed grew, the work week remains tightly range-bound, and wages continue to be uninspiring especially in the face of the exceptionally weak Productivity and Costs report from earlier this week. Of significant note is that the diffusion index in manufacturing has been struggling to stay at 50 and fell below again in May. That tells us the manufacturing sector is in contraction.

The Blue World Economic Index is still slightly negative, with 4 out of 8 segments sporting negative composites so if you employ real people, run a real business, and invest real money we recommend continued caution.

More positives than usual for May of 2015 might be a good start but as we know, it’s not the report that matters. It’s the trend.

So…here’s to hoping for a positive new trend!

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, June 05, 2015