Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Sensitivity: VERY HIGH

Management Value: VERY HIGH

Tuesday, March 10, 2015

Brain surgery is not rocket science to a brain surgeon©

SOMEONE forgot to set the office clocks ahead…

We owe two apologies this month. One is for the tardiness of our analysis and the other is that, well, “analysis” may be giving what we do the benefit of the doubt. We can reduce this post to mere bullet points because “analysis” becomes unnecessary once patterns are so established as to require nothing more than cursory observation to verify the patterns are intact. Heck, it’s so simple event the “experts” are starting to get it! In spite of a “great” number like 295k new jobs, we are hearing “experts” talk about things like participation rate, labor force size, and they’ve even realized there is a data set for the total number of those not in the labor force (who, by the way, are not counted as unemployed)! Wow, that only took a 6 year recovery to discover…

Here are the bullets:

- 295k net jobs

- 288k net jobs in the private sector

- Participation rate 62.8% (down .1%)

- Not in Labor Force grew by another 354k

- Weekly hours flat

- Weekly hours in manufacturing flat

- Weekly overtime hours in manufacturing flat

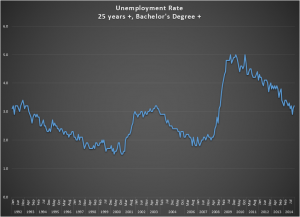

The unemployment rate is irrelevant and no longer a proxy for the health of the economy. The evidence is building to support the position that a material percentage of the new jobs are going to illegal immigrants and wages are just barely tracking even with inflation. That last piece is part of the evidence set regarding the illegals.

It’s a mess…and the “experts” appear poised to get it.

We’ll try to be on time next month but in the meantime we hope Spring is springing wherever you are!

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Tuesday, March 10, 2015