Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Sensitivity: VERY HIGH

Management Value: VERY HIGH

Friday, January 09, 2015

Brain surgery is not rocket science to a brain surgeon©

Do you hear us, AND ARE YOU LISTENING?!?

Happy New Year everyone! We hope the Christmas season was safe and joyous. Now, back to business. The jobs report is out and we’ll comment on it as usual but we will also offer a bit broader overview of how the economy fared in general for the period of 2011 – 2014. We think you’ll find it rather sobering as we did.

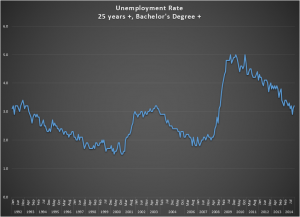

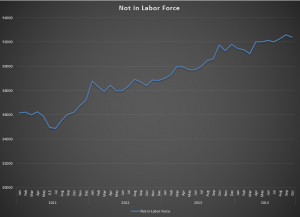

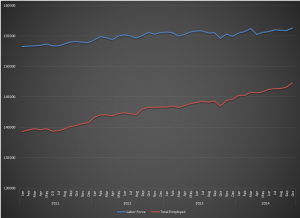

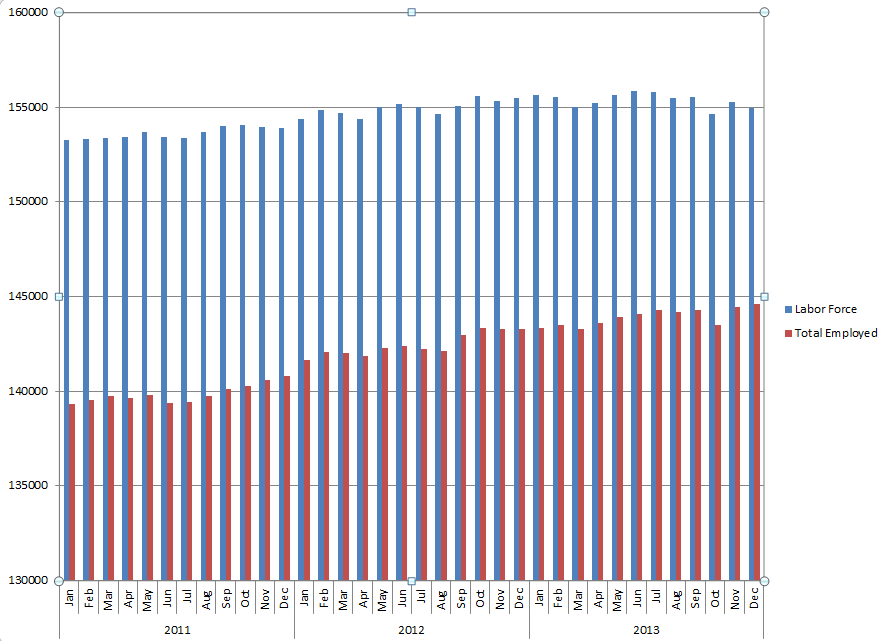

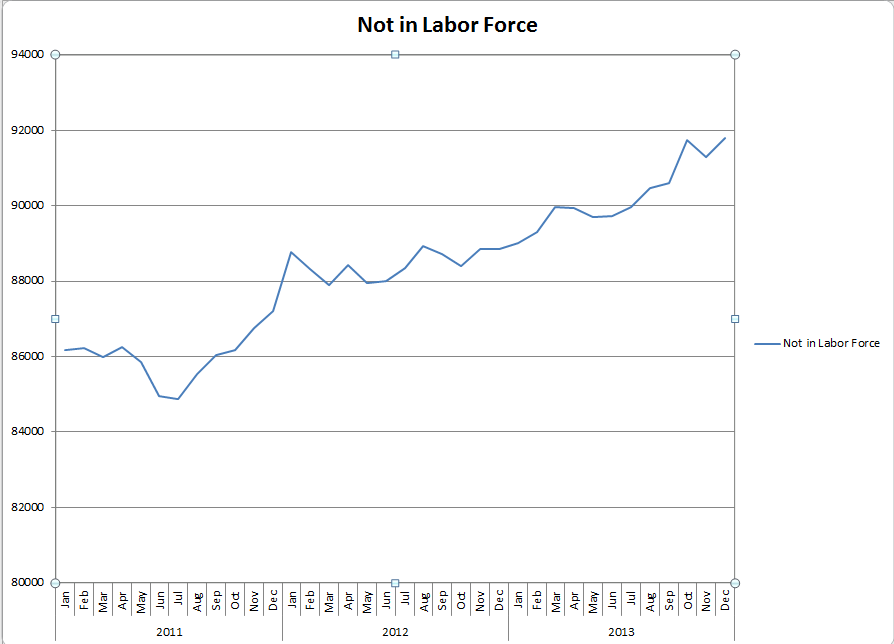

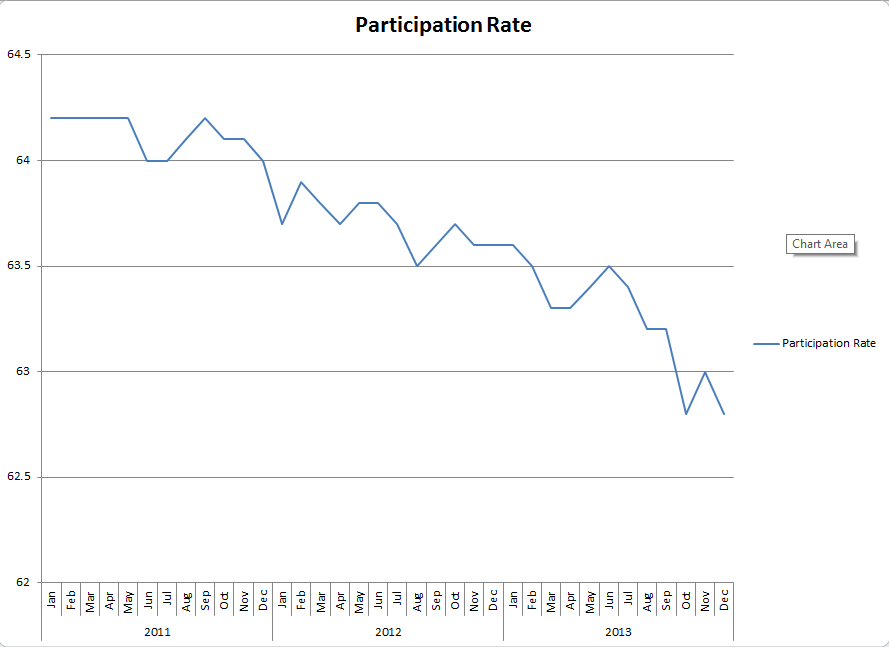

First, the jobs report. Same ‘ole theme of a decent number of new jobs with the private sector breakout sporting a little less luster than the headline number, which came in at 252k, 12k more than the private sector total. The labor force shrank by another quarter million plus so, as has been the pattern, the number of those employed grew at a faster rate, further enhancing the irrelevance of the unemployment rate calculation. The “Not in Labor Force” tally swelled by another half million driving the Participation Rate to equal its “recovery” record low. There were corresponding spikes in the “Marginally Attached” and “Discouraged Workers” yielding a true unemployment rate just north of 11% which is, of course, also optimistic for the same reasons as the headline number. Wages across the board, and notably in construction and manufacturing, took a noticeable hit with some downward revisions to previous periods. The work-week length remained stagnant, BUT there may be a brightening spot. The overtime hours in manufacturing has demonstrated small but nevertheless consistent increases for the 4th quarter. Let’s hope that holds.

Annual revisions to the prior data will be showing up beginning next month so graphs may look a little hinky as they can at each New Year, but the patterns will be valid. Here are some sobering statistics.

Percent Change for the period:

| 2013-2014 | 2011-2014 | |

| Labor Force | 0.32% | 1.45% |

| Total Employed | 1.64% | 4.38% |

| Participation Rate | -0.61% | -2.00% |

This shows quite clearly why we say the unemployment rate as published has lost all credibility and value as a proxy for the health of the labor market and economy at large.

Speaking of the economy at large, well, it’s not declining, but it’s not advancing either. Blue World tracks over 40 reports per month from both private and public sources in the following 8 categories:

General measures (i.e. GDP)

Consumer mood and activity

Employment

Inflation

Manufacturing

Residential Reals Estate

Retail Performance

Services Sector

Of those, in 2014 five categories were in mild positive territory as analyzed internally at Blue World, and three were slightly negative. All told, this is still an economy waiting for a direction. We have repeated the sentiment that policy matters, and it is no secret that we have been very critical of the ones in place. We don’t care what works, just that it works…and these don’t. We voters expressed a desire for policy change, and our new hires will take office this month. Let’s pray they’re listening.

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, January 09, 2015