Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Sensitivity: VERY HIGH

Management Value: VERY HIGH

Friday, June 06, 2014

Brain surgery is not rocket science to a brain surgeon©

Release Site: www.bls.gov

“The Labor Department said the economy has now recovered all 8.7 million jobs lost during the recession.”

Sometimes the only word that fits is “fraud!” Maybe it has taken six years for the world’s biggest, strongest and best economy to generate 8.7 million jobs. That’s certainly nothing to be proud of when we consider it only took about 18 months to lose them, and our prior postings show the graphs of this “recovery” relative to all of the other legitimate recoveries since the 1970’s. Those charts can be reviewed in our post A Flute with no Holes is not a Flute and a Recovery with no Jobs is not a Recovery

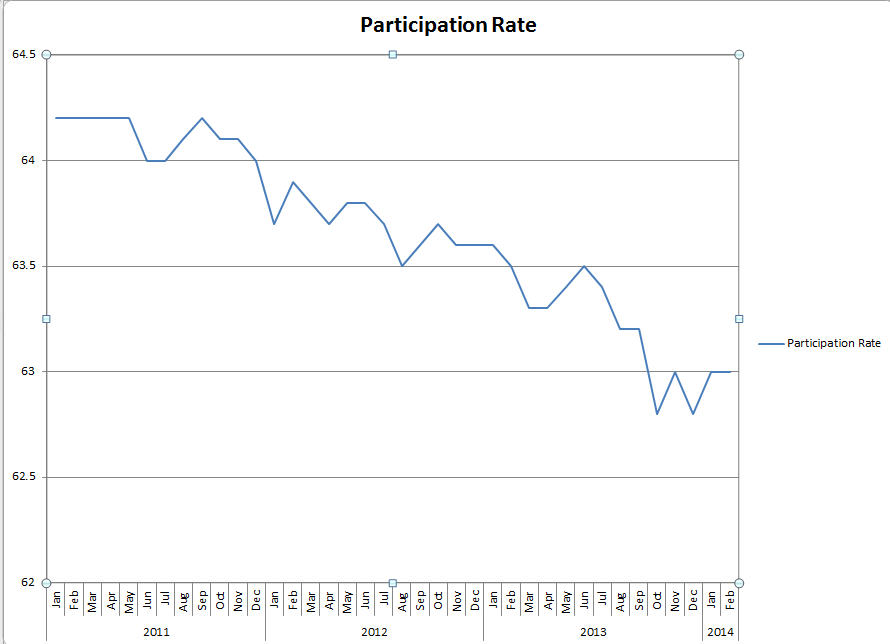

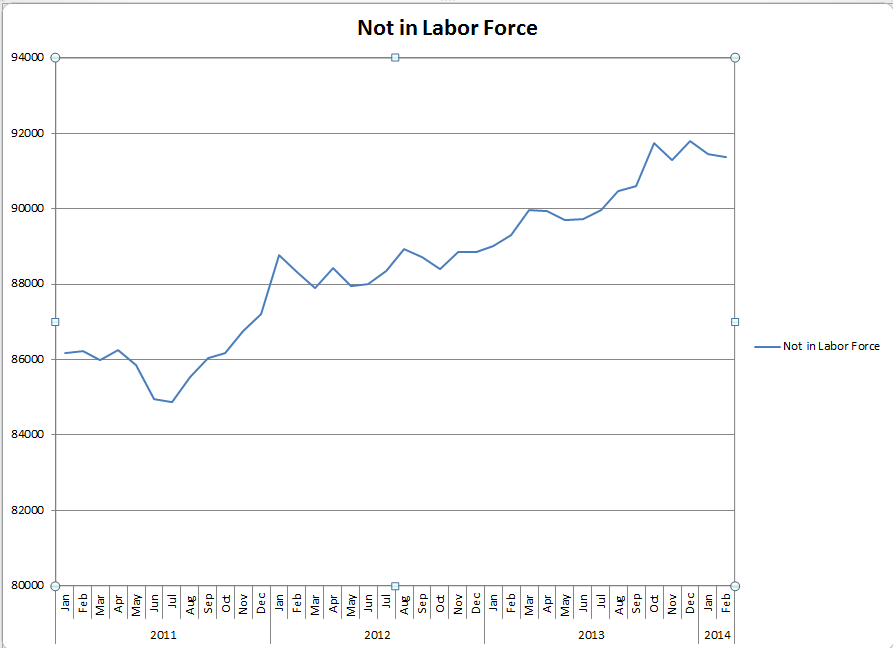

It is unconscionable to portray this as a milestone when the number of unemployed people has exploded, the participation rate languishes at all-time record low levels, the labor force is less than two million workers bigger than it was in 2008, and the increase of Americans receiving food stamps has outpaced the number of Americans getting jobs! Then we have to consider the technical stuff about how the numbers are tabulated and realize that those who are out of a job but have not looked for work in the last four weeks are not even counted. Let’s hunt the elephant in the room and remind ourselves that a few months ago the Obama administration was caught red handed fudging the counts on the household survey to make the picture appear better. Makes it kinda tough for lowly employers like us to make decisions based on the “data.”

The numbers are as expected. 217k hires nets us 216k in the private sector by subtracting the 1k added by government. The unemployment rate, which is hardly worth acknowledging anymore, held at 6.3%. That fuzzy math we’ve become so accustomed to is still at work.

In spite of the 217k, the number of unemployed persons rose again and the participation rate held at 62.8%, extending its all-time record low level to two consecutive months and the fourth month at that level since October ’13. There was a sharp rise in the number of those unemployed between 1 and 14 weeks. That is validated to some degree by the recent streak in the weekly jobless claims. The work week is flat at 34.5 hours for a third straight month with overtime in manufacturing following suit. The construction industry actually saw their week shortened a bit. Overall, wage growth remains unexciting.

“Fraud! Cried the maddened thousands and the echo answered Fraud!”

Full points to anyone who can tell me what poem that’s from. Hint: it’s very apropos.

As always, we truly appreciate your time. Thanks for reading and, please, stay tuned…

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, June 06, 2014