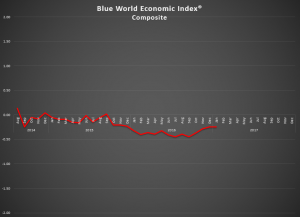

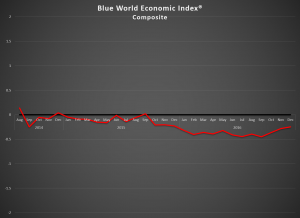

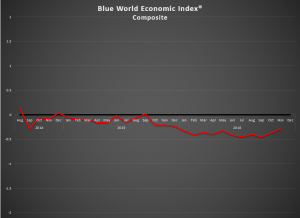

Blue World Economic Index®

Scale: -2 to +2

Release Date: Usually the Last or First Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Wednesday, February 1, 2017

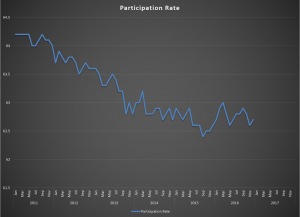

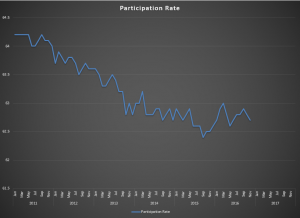

The BWEI® was flat at -.25 to the December 2016 reading, but there was news in the detail, the biggest of which was in Manufacturing. While the overall reading was flat, a win unto itself these days, the Fed sub-group, made up of five regional Fed Districts plus the Chicago National Activity Index, made a big move to the North breaking above zero to a plus .3. That’s huge and, hopefully, heralds the beginning of movement for the whole category. The other up-movers of the eight major categories included Consumer, Inflation, Real Estate, and Services, while Employment, General Measures and Retail slipped.

There is no longer any doubt that the election is driving the positive movement in Consumer measures as well as optimistic business outlooks as surveyed by the various relevant reports. Let’s hope that optimism is rewarded with some movement in the hard data. We’ll have to be patient. It depends on the implementation of executive policy change, speed of legislation, reaction time, and follow-through. Based on what we see so far, we don’t expect to enjoy any meaningful trend analysis for the headliner numbers of the monthly and quarterly reports until about Q3. In the meantime, the ones to watch will be the weekly releases on Consumer measures and the outlook components of the monthly business surveys. If the optimism holds and grows then the hard data should follow along. Here’s to hoping it materializes just that way!

As always, thanks for stopping by.

The Blue World Jobs Report Analysis will be out Friday morning. See you then.

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release sites should be cross referenced. The index assignments represent the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on the index.

©Blue World Asset Managers, LTD Wednesday, February 01, 2017