Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Friday, May 06, 2016

Brain Surgery is not Rocket Science to a Brain Surgeon©

WHOA UGLY!!! (Full kudos if you email us with the movie)

The “experts” continue to baffle us… not really… Everyone is acknowledging the report is dismal, but we’ve already seen the “positives” in the report being touted by some “experts.” Well, if one only sits in a cubicle analyzing data, we suppose numbers are “positive” if above zero, but that does not necessarily translate to “positive” news on the economy for those who employ real people at real jobs for real wages in the real, outside-my-expert-cubicle world! Let’s dig in…

The headline is 160k, but the news is better for the private sector which came in 11k higher at 171k. If you wanted to leave after the good news…well…have a great weekend. For the rest of us… Last month we reported the problem with the Private Sector counts being well below the headline and running at 195k for Q1 2016 vs. 222k for all of 2015. 222k is not stellar, but it is at least above 200k. The big news today is actually in the downward revisions to February and March 2016 of -14k and -11k, respectively, bringing the Private Sector average through April 2016 down to 183k. That just won’t get it done, folks.

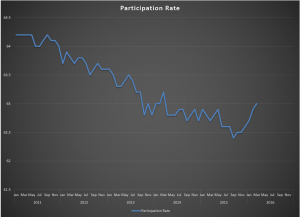

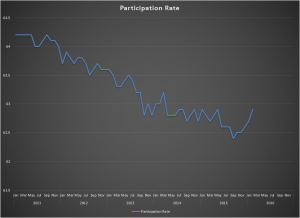

The Labor Force got smaller, and the Not in Labor Force number got bigger, which ended the recent climb by the Participation Rate in spectacular fashion, which fell all the way back to 62.8%. What that means is that 37.2% of able-bodied, out-of-work Americans are not even participating in the jobs world. That keeps the number of those not in the civilian labor force at over 94 million.

Some “experts” have said that revisions are minor. No they’re not. (See Private Sector revisions and averages above.) Some “experts” have said that the news on wages was a positive because they are up .3% YTD and 2.6% since April of 2015. Looks good from inside an “expert’s” cubicle…unless, of course, one has reviewed AND remembers the Productivity and Costs report for Q1 2016 which came out a full 48 hours ago showing diminished output on higher pay driving productivity down and labor costs up. In order for wage pressure to be good news for a real manager of real people in the real world, more pay must translate to more productivity. This is why you follow us… The Labor Market Conditions Index will be out on Monday morning which the Fed follows closely. You can see our quick analysis on Twitter @BlueWorldMatt.

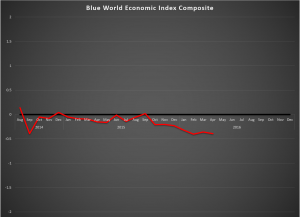

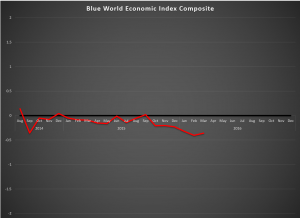

The Blue World Economic Index® has taken quite a hit in this first week of May 2016 falling from -.39 to -.44. A lot more data is still to come this month, so we don’t necessarily expect numbers quite that bad to hold but we are prepared to say the Fed meetings will likely be quite the yawners.

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov