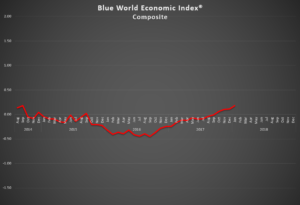

Blue World Economic Index®

Scale: -2 to +2

Release Date: Usually the Last or First Business Day of Each Month

Release Site: www.blueworldassetmanagers.com

Management Value: Critical

Date: Thursday, March 01, 2018

Analysis

Confirming our regular observation that stock market performance is not a good proxy for economic health, the U.S. economy remained firmly on solid ground in February 2018 pulling back .04 from its record high .18 for December to its prior record high of .14, but there were some hints at trouble. The first half of the month looked to continue an uninterrupted northerly trend, but then mid-month started getting weird with a huge downgrade to December retail, soft January readings and a sudden build to inventories at the manufacturer and wholesale levels. Retailer inventories remained low, but the obvious concern now is that the motivation to aggressively re-stock may be muted.

The Inflation composite was unchanged at a continued weak -.23. The PPI had been showing signs for months, but the CPI just never followed suit. This month it was the CPI showing a material pop and the PPI showing weakness. The Fed is signaling more rate hikes, and that has spawned “Correction Part Deux” this week. We remain of the opinion that inflation is not a material risk at present based on the inconsistent and non-confirmatory nature of the six reports that comprise the BWEI® Inflation component.

While we still consider the Fed to be the biggest risk to the economy right now, there are several other things we could talk about but only two of real note. First is that the Consumer component is still stratospheric, regularly setting new records, and showing no sign of slowing. Second is the seemingly emergent turbulence in Real Estate as (you guessed it) rates rise. We are starting to see corroboration in other subtle corners of the economy such as the wobbly performance of furniture sales in the last couple of months.

We’ve already fielded a couple of questions regarding the downward revision to GDP. Fuggetaboudit. The downgrade was largely based on the inventory phenomenon and a blip widening of the trade gap as exports took a hit. That masked what was an otherwise 4%+ report.

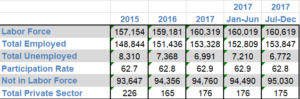

The Numbers

We got a little long-winded in the analysis section, so instead of listing out the numbers we decided to just post the composite table for the month. If there are any specific questions, give us a call or ping us through the Blue World contact form.

The jobs report has been scheduled for Friday, March 9th. Our analysis will be up that morning and then Matt will go on the air in Chicago with the Noon Business Hour crew at WBBM AM780 and 105.9FM at 12:09 central time to break it down live. The podcast will post later in the day.

Have a great March and may your brackets be un-bustable!!

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release sites should be cross referenced. The index assignments represent the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on the index.

©Blue World Asset Managers, LTD Thursday, March 01, 2018