Thursday, September 13, 2012

Ignorance is curable. Stupid is forever.©

Messin’ with Markets is More Dangerous than Messin’ with Sasquatch!

Time to Roll Up a Newspaper and Smack the Market “Experts” on the Nose!

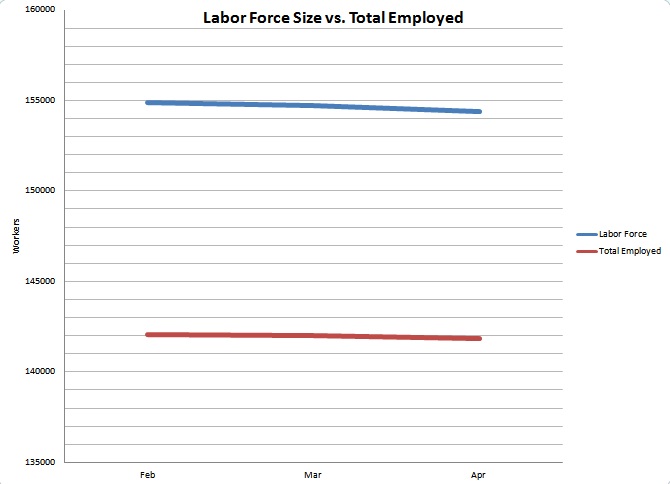

GDP is below 2%. Claims for unemployment benefits are up and get revised higher every week. A record number of Americans are on government assistance. Social Security and Disability benefits hit record highs with a full month left in the fiscal year. Consumer comfort, confidence and sentiment are low and falling. Investor confidence is weak. Manufacturing is contracting. The Eurozone is on the brink of financial collapse. Our national debt is over $16 Trillion. Foreclosures are high and rising. Terrorists are attacking U.S. Embassies around the world and murdering Americans. And unemployment is over 8%…for over 40 months…yet, somehow, the Dow is up over 200 points on 9/13/2012 because the Fed announced QE3?

It should be of tremendous concern to everyone who has investments in the public markets that market performance has become SO dependent on government action. Do you realize that the actions contemplated by governments have become more important to the public markets than business fundamentals? Governments don’t even have to do anything. All they have to do is hint that they might do something, and the markets go crazy. It may be a suggestion that the Europeans may bail out Greece, or it may be the U.S. Fed announcing a new round of stimulus, as is the case today.

Let us explain what Quantitative Easing is in simple terms, then decide if you want your investment nest egg tied to more of it. In its simplest terms it is trading short term debt for long term debt. It is the proverbial kick-the-can-down-the-road exercise. The Fed uses our money (tax receipts) to buy back short term bonds (loans to the government) and refinance them for a longer term. The massive buy-back causes a drop in interest rates that is expected to stimulate the economy. It is the exact opposite of what they do during boom times when they think the economy is “overheating” and they want to avoid inflation by artificially raising the interest rates to slow things down.

Folks, we’re telling ya, messin’ with markets is more dangerous than messin’ with Sasquatch! At some point this will have to revert to being about economic fundamentals. When it does we recommend having the A-Team defense on the field or watch from the stands because it could be a catastrophe.

We can’t understand the exuberance at any level BECAUSE IT DOESN’T WORK, but we would think that the “experts” who get so giddy about such stupid and detrimental policies would have a learning curve that breaks off 180° somewhere. After all, we have plenty of evidence that these measures don’t work in the face of the current economic environment. You know what they say about the definition of insanity being the duplication of effort over and over yet expecting different results? O.K. the “experts” are not just morons, they’re insane.

For those of you wondering how we can make such assertions regarding the ineffectiveness of prior actions rendering the current ones “insane”…

GDP is below 2%. Claims for unemployment benefits are up and get revised higher every week. A record number of Americans are on government assistance. Social Security and Disability benefits hit record highs with a full month left in the fiscal year. Consumer comfort, confidence and sentiment are low and falling. Investor confidence is weak. Manufacturing is contracting. The Eurozone is on the brink of financial collapse. Our national debt is over $16 Trillion. Foreclosures are high and rising. Terrorists are attacking U.S. Embassies around the world and murdering Americans. And unemployment is over 8%…for over 40 months…

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. Referenced sources should be reviewed. Any analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Thursday, September 13, 2012