Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Friday, February 03, 2017

Brain Surgery is not Rocket Science to a Brain Surgeon©

OOHHH, WHAT A SURPRISE!

… but not for the reasons the “experts” think. We’ll explain.

This White House seems to be working fast, but nobody’s that fast. In other words, don’t look for this to anchor a gigantic new trend quite yet. The real surprises for those who invest real money, manage real businesses, and employ real people are in the details. We’ll point them out.

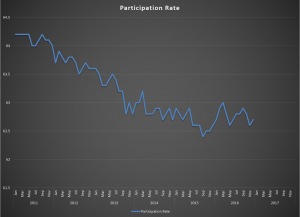

To start, the total Unemployed grew by more than the total Labor Force, but both were positive numbers and widened the spread, so the Unemployment Rate (who cares) ticked up and that was a good sign in this case. As we’ve said, the Unemployment Rate is no longer a reliable proxy for the actual health of the Labor Market. The Participation Rate ticked up .2% to 62.9%. That is still horrible, BUT… that stat usually moves .1% at a time. When we’ve seen bigger moves they have typically been in the wrong direction, so a .2% move to the North is a welcome departure.

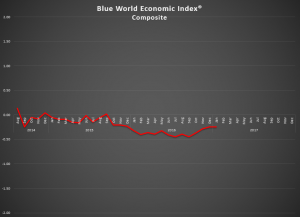

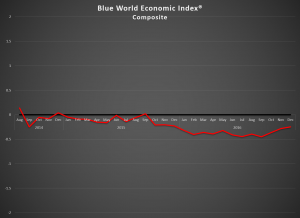

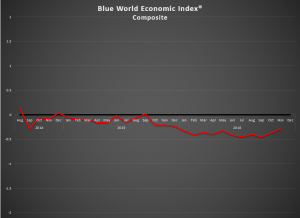

The real surprises? OK. We always point out the headline number is never the one we care about because it includes both Private Sector and Government hires. We only care about the Private Sector when analyzing the economy, and we have been accustomed to writing about the Private Sector totals being lower that than the headline tally. If you’re new to this report or just missed last month, we describe this in some detail here. The three-month revisions to the Private Sector numbers netted us plus 1k jobs. The Private Sector net total for January was 237k, 10k higher than the 227k headline, because the Government shrank its workforce by 10k. That’s before the hiring freeze was completely in effect. Another surprise was the accuracy of the ADP report. Their number was only 9k off of today’s BLS. Believe us, that is a surprise. The counting methods of the two reports are so different that the ADP report usually gives a hint of direction but not such tight agreement in totals. The really big news, however, is with regard to the Not in Labor Force totals. For the last two months we have been over the 95M mark, and that is staggering. Remember, these people are not counted as “unemployed” in calculating the Unemployment Rate because they have not looked for work recently. This is why we hear people talk about the true unemployment rate, which is still double digit, if we include the NILF in the unemployed count. That number fell by three-quarters of a million people last month! We don’t recall that kind of a drop in a single month. That number is confirmatory of several important indicators. First, it validates the big jump in the Participation Rate as non-participants are re-entering the labor market. Why? Because, suddenly, they have renewed optimism that jobs will be available. This is also confirmatory of the Consumer and business outlook metrics followed by the Blue World Economic Index®, all of which cite positive outlooks by consumers to find work and businesses to offer work.

No positive change was ever precipitated by pessimism, as demonstrated in the last eight years. We do not make political statements through these reports. We don’t care what works, as long as it works. And by “works” we mean policy creates an environment conducive to economic expansion through private sector enterprise growth. Period.

All that said, don’t get crazy. This is just one report, a single data point. Unto itself it means virtually nothing. Policy needs to be implemented as advertised, have a chance to bear fruit, and adjustments made if needed. That takes time. We estimate Q3 before we have the earliest pattern indications of what this will all mean so hang in there and we’ll see you back here at month’s end for the Blue World Economic Index® report.

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov