Wednesday, June 26, 2013

Ignorance is curable. Stupid is forever.©

Pixels vs. Images: A Quick Take on GDP, Markets, Business and the Economy

So, China growth slows and the U.S. markets tank. U.S. growth slows and the U.S. markets fly? That’s what happened this month. We even saw a market “expert’s” headline today “GDP Revised Down but Street Still Optimistic on Economy.” “Based on what” is the question we’d ask. Again, every headline today indicates the drop in GDP was “unexpected.” This continues to be our problem with the “experts.” They read one day’s news and proclaim a definitive view on the economy. The next day some new data is released and we get a whole new view, as if yesterday’s news was totally negated or, even worse, totally forgotten.

For market investors that’s fine AS LONG AS they know how to play defense. We, obviously, don’t object to a rising market whatever the reason. We just worry about the folks who are naked. As we’ve said, it makes us nervous when there are no fundamentals to support a bull market. We are happy to make money on it but we are ready for reality shocks, too. As long as you’ve got your swinging accounts, stops, puts, inverse ETFs, long-short strategies, or whatever other defense you/your advisor employs then let the market run and run with it. We do.

Running a business is a different story. As managers we have to be more concerned with economic fundamentals because we don’t have the kind of defensive measures that are available in the markets. The only defense we have is a keen awareness of what the economy is actually doing so that we can make appropriate decisions on everything from hours of operation to inventory stocks to employment.

The deplorable GDP is NOT a surprise if we’ve watched AND REMEMBERED all the other reports from this and previous periods. No report is valuable unto itself. Each must be viewed through the prism of the universe of data sets. Then each new data set must be triangulated with and compared to the rest of that universe. It’s the difference between viewing a single pixel vs. the entire image. Each data point that is released is just a single pixel in the image that is created when all the pixels are viewed together.

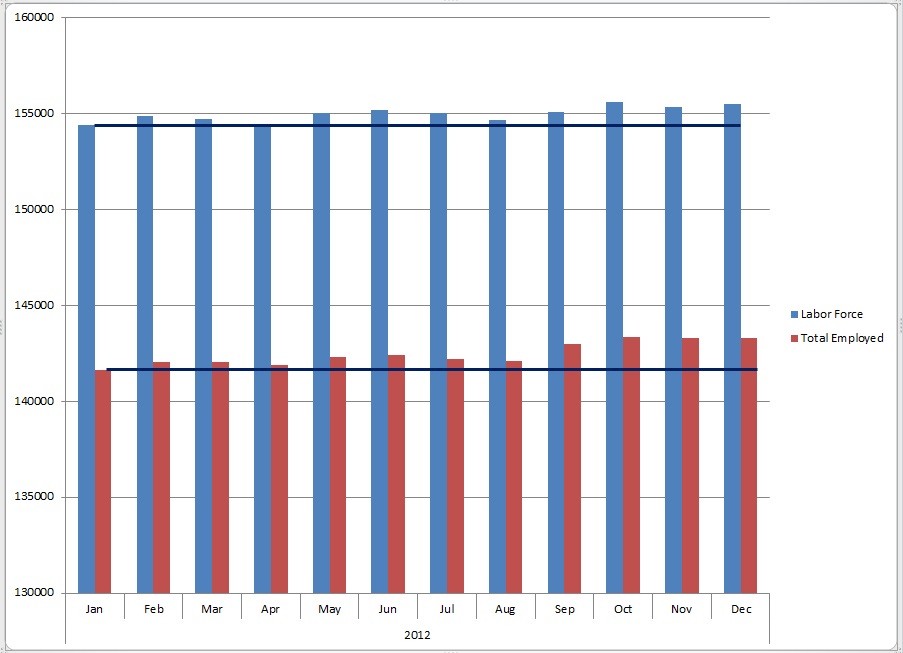

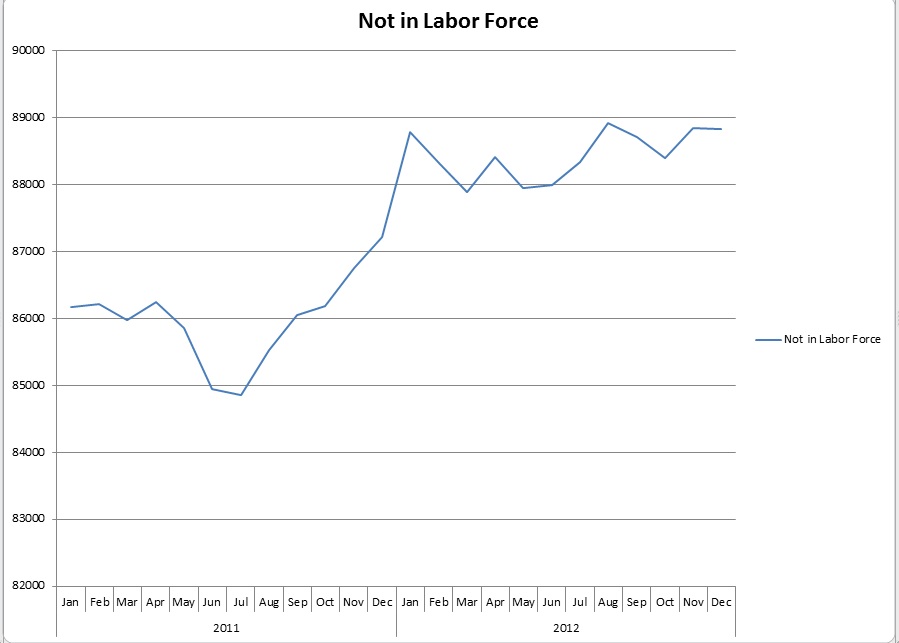

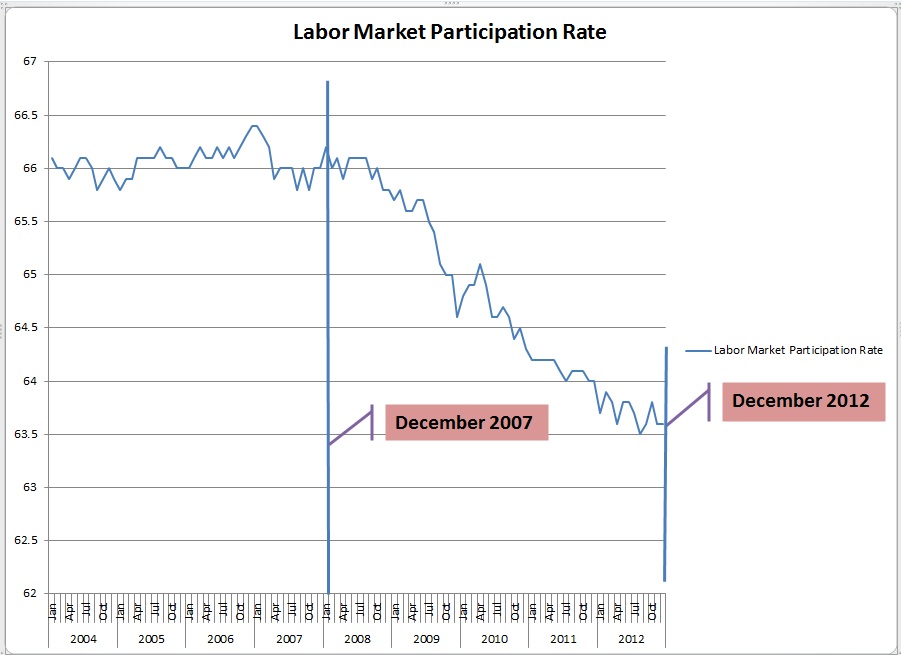

That’s how Blue World does it. For example, starting with the two most recent employment reports (Blue World Analysis at & ) we saw a continuing trend of flat hours, overtime hours and wage growth in manufacturing. The diffusion index (number of companies hiring) fell below fifty percent and the labor force remains stagnant. Then, all the regional Fed reports ranged from negative elements to negative across the board in each of the last two months. Sure, we hear some of you yelling at us about the positive Durable Goods report this month but, again, viewed historically the reports has been very volatile. “Good” is nowhere near what “good” should/used to be and the current year over year level is no better than February of 2012 and far worse than it was in 2010! See Econoday’s chart at .

The markets do not reflect reality. Please don’t use them as a gauge to make decisions in your sector, business or department. Just ride them as they produce and let us know if you’d like help with the defense.

There is tremendous uncertainty regarding the effect of tax policy, ObamaCare, immigration reform and a multitude of other domestic and international issues. Follow Blue World for a big-picture take on the economy and to aid in business decisions. Call us for individual help and analysis.

Our assessment continues to be that the economy is not in a meaningful recovery. We have an extensive collection of pixels that we organize into an image to back up that assessment. That’s why we typically only use the word “unexpected” when we read an “expert” who got it right.

As always, thanks for taking the time and stay tuned…

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. Referenced sources should be reviewed. Any analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Wednesday, June 26, 2013