Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Sensitivity: VERY HIGH

Management Value: VERY HIGH

Friday, June 07, 2013

Brain surgery is not rocket science to a brain surgeon©

Perhaps the most exciting thing about the jobs report was our typo last night on Twitter! We were asked for our prediction and we said “more of the same” but we typo’d >200k new jobs instead of <. Sorry. The appropriate parties are being waterboarded…in Egypt, of course.

The rest of it, well, we nailed it. I wish we could claim some genius status for that, but how could we? The pattern is well established, and there have been no economic or policy shifts during the last month that would precipitate any meaningful change.

The biggest “news” out of this report came in the form of adjustments made to the prior two months which demonstrate a net 12,000 fewer jobs than initially reported.

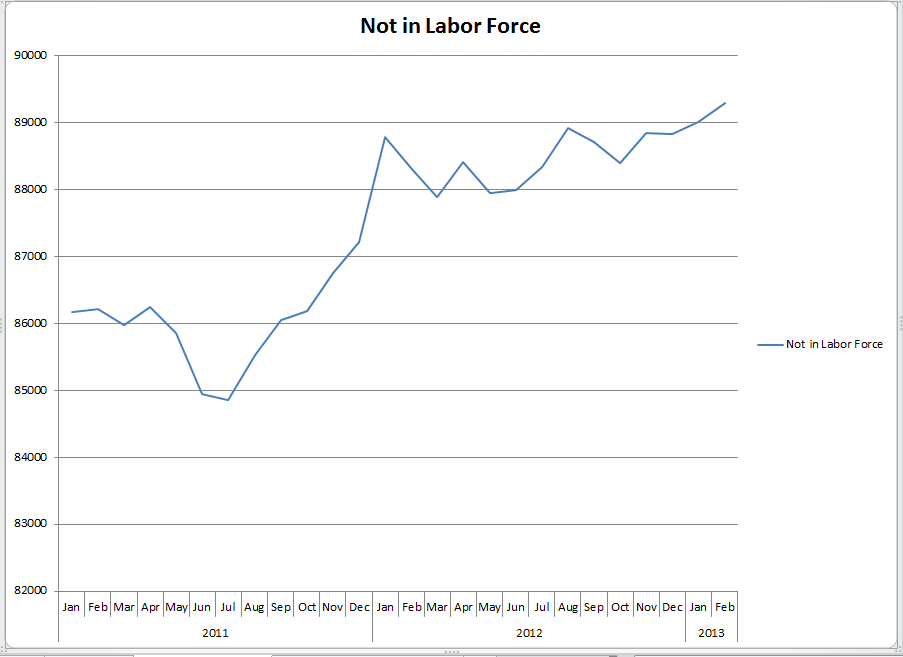

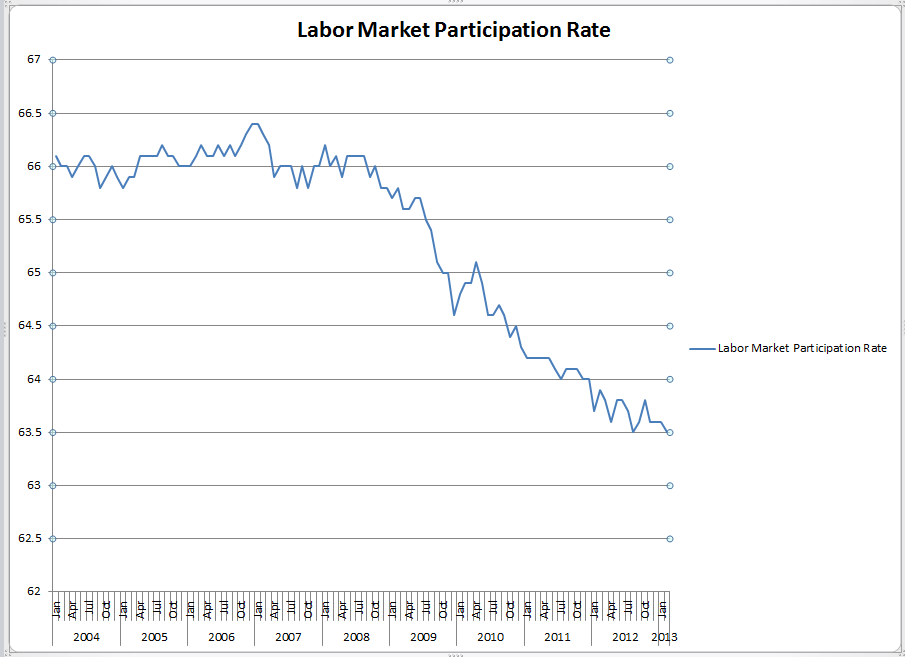

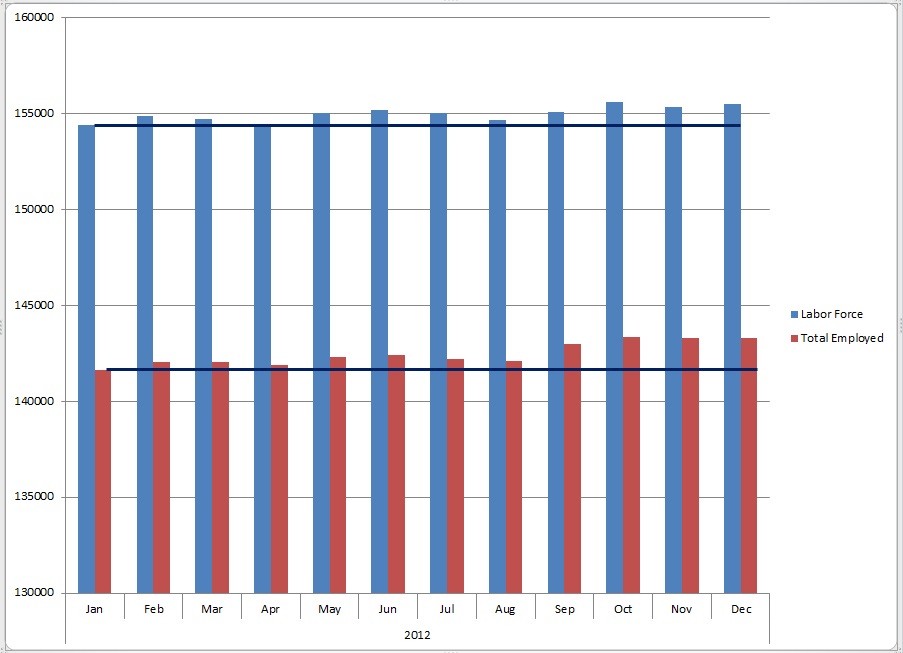

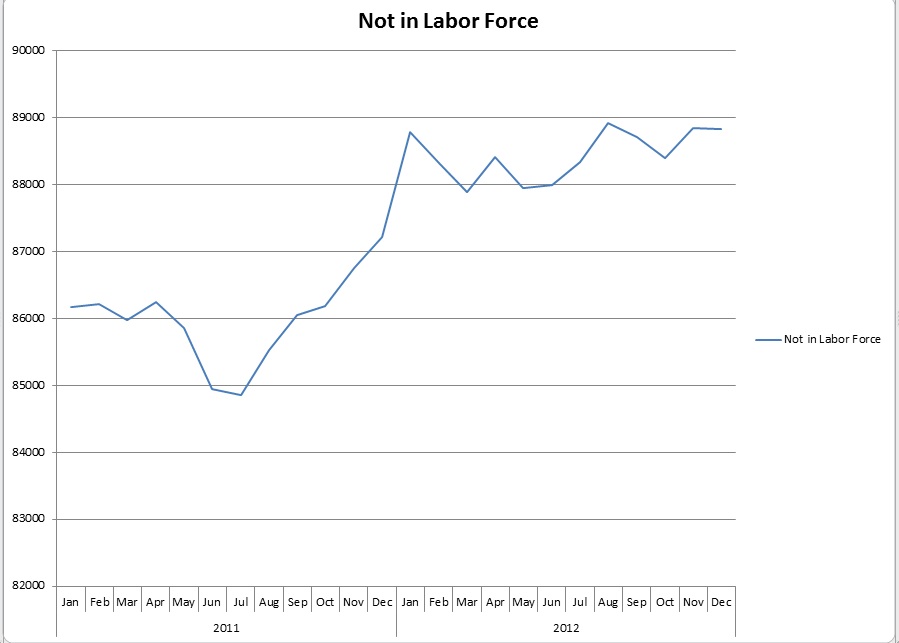

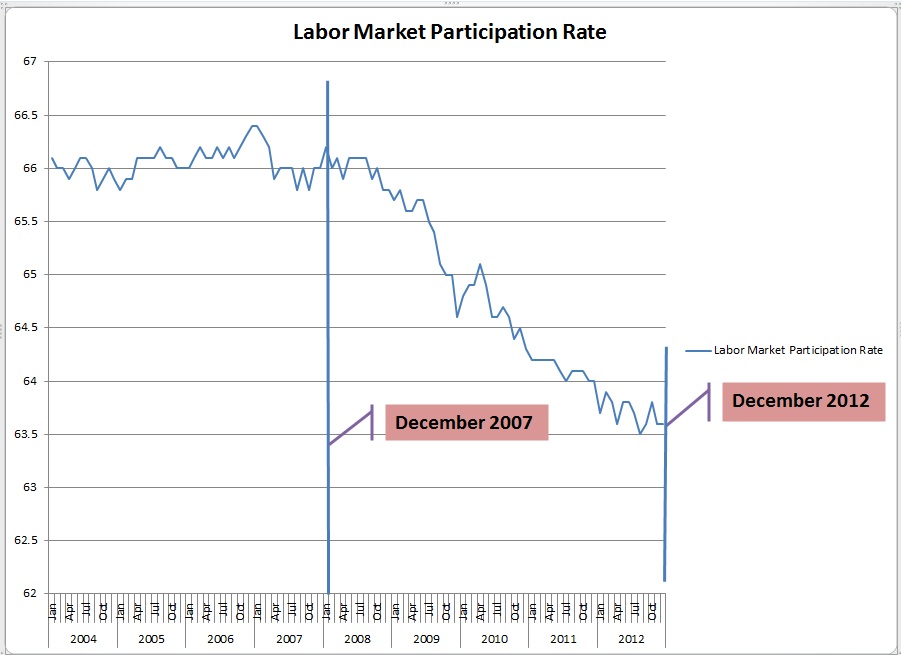

175 thousand new payrolls are reported for May, which is still up to 75 thousand short of break-even. The number of those reporting as employed rose, but so did the number of those reporting as unemployed. This month the growth in the labor force was proportionately larger than the gain in the number of employed persons, hence the uptick in the rate to 7.6%. All were uninspiring as validated by the continued weakness in employment-population ratio and the participation rate which, by the way, are each equal to and below where they were in May of 2012, respectively. Overall, wages are still stagnant and the work week length remains flat.

Manufacturing Has Become a Real Concern

In addition to developing a three month job shedding trend, weekly manufacturing overtime among all employees continues too short and unchanged. More troubling, however, is that the production and non-supervisory set has established a three month downward trend from 4.4 hours of overtime per week in March to 4.2 hours in May. The diffusion index is still a contractionary sub-50 reading. All of this is consistent with what we saw during the month coming out of the regional Fed reports where four of five were negative. On Monday we Tweeted sarcastically regarding the “experts’” surprise at the negative ISM report. Perhaps the anemic GDP could have offered them more clues…

As much as we like them, there is no need for multi-colored charts and graphs this month. The patterns are, unfortunately, consistent.

We are seeing words from “decent” to “fabulous” in describing this report and the “continued recovery” of the labor market. The markets are responding accordingly, but if you invest real money, manage or hire real people or are responsible for the wealth of yourself or others make no mistake, this is a very poor report wearing the makeup of headline numbers and media spin.

This is the United States of America. When was 7 percent unemployment EVER acceptable for even a short time? Unemployment above 7 percent for this long with stagnation from the labor force size to wages is utterly unacceptable and completely avoidable. We can’t say it often enough. Policy Matters!

Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, June 07, 2013