Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Friday, August 05, 2016

Brain Surgery is not Rocket Science to a Brain Surgeon©

This is the best report we’ve seen in a long time! Most of the highest value details moved the right direction. Not enough to improve the overall labor or economic picture, but we have to start somewhere. We’ll explain.

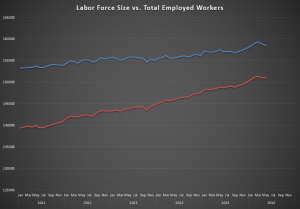

Net jobs were positive and the Labor Force grew. The Participation Rate ticked up a tenth, and the number of those Not in the Labor Force fell a bit. The number of those reporting as Unemployed fell while those Employed rose. Wages showed a little life, and there were some positive revisions to the last couple of months. Hours worked are still stubbornly range-bound, but we can’t win ‘em all.

So, what does it mean to business managers trying to make forward decisions?

There is already irrational exuberance in the media about this report, and neither the exuberance nor the irrationality is entirely unjustified this time. Strength is strength, and this report has plenty of it. However, the headline is 255k net new hires, but the private sector accounted for only 217k of those. That keeps the 2016 average sub 200k and well below 2015. There are still over 94 million Americans out of work as corroborated by a Participation Rate at 62.8 percent and wallowing range-bound at historic lows.

What should we be worried about?

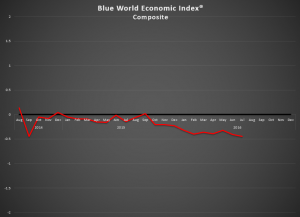

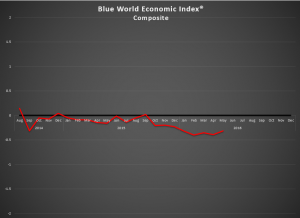

If this report heralds a true turning point, we can count on the Fed the screw it up by raising rates too much too soon. This is now a real concern for the September meeting as the hawks are feasting on this data. Trust us on this much, this economy IS NOT in danger of overheating and does not require a restrictive rate hike. You can see more about that at the Blue World Economic Index® Lots more data will come out between now and then. We’ll be watching closely and updating along the way.

In the final analysis this report can and should supply a breath of cautious optimism, but remember, the report is just one report and doesn’t matter unto itself. We’ve seen this head fake before. What matters is the trend, and here’s to hoping this is the end of the current one and the beginning of a new one.

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov