Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Friday, December 02, 2016

Brain Surgery is not Rocket Science to a Brain Surgeon©

Yup! The “experts” think it’s good. Of course the “experts’ are not making decisions about hiring, purchasing, borrowing…, ya know, all those things required to run a real business. From that point of view, it’s not good. The headline is 178k, but the private sector only added 156k. The average new hires for the private sector are running well below the 2015 average and below 200k at just 164k per month.

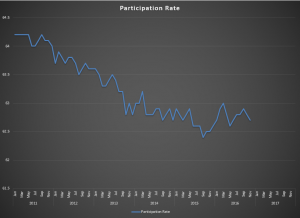

At this point our readers know the words to the “Why did the unemployment rate fall?” song. As has been the case for over seven years, the change in employed has outpaced the change in the labor force, moving the lines closer together to give us an artificially low unemployment rate. As a matter of fact, the Not In Labor Force total raced above the 95M mark driving the Participation Rate down to 62.7, the third worst reading in six years. That’s the graph this month, back to 2011. Recovery, indeed!

There is much ado being made of a pullback in wages from last month, but this really isn’t that big a deal considering the year on year rates remain tolerable. We’ll only get nervous if we see an actual backward trend developing. A bigger concern is the continued absolute stagnation in the workweek as well as a Manufacturing Diffusion Index below 50 for a couple of months in a row. A year ago that number was comfortably above breakeven at 55.1 indicating net expansion of payrolls across the 79 manufacturing industries. Not so in ‘16

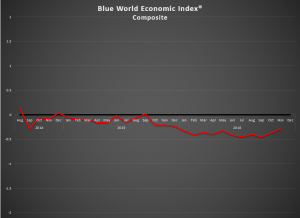

Did the analysis seem a bit light (less wonky) this month? Economic data comes to us in three levels of timeliness; quarterly, monthly, and weekly so even the most current information is still lagging. For two administrations now, we too often have ended with the phrase “Policy matters, and these aren’t working.” We have plenty of reason to believe that we are about to see a significant change in policy, and that will render detailed analysis of lagging data largely intellectual for a quarter or so until new policies have had a chance to establish an actual vs. anticipated impact. The Blue World Economic Index®, published yesterday, provides a much broader view of this.

This is the last time we will hit the “Publish” button for the jobs report analysis in 2016. We can’t believe it’s another trip ‘round the sun come to an end. As a friend once said “The days are long but the years are short.” God bless you. Merry Christmas. Happy New Year and we’ll see you on the other side.

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.