Blue World Employment Situation Report Analysis

Release Date: Usually the first Friday of each month

Release Site: www.bls.gov

Market Sensitivity: VERY HIGH

Management Value: VERY HIGH

Friday, February 01, 2013

Brain surgery is not rocket science to a brain surgeon©

The operative word today is…spin. When we saw the jobs numbers at first pass we thought “wow, this is ugly.” Now we go and read the BLS summary and some stuff around other notable publications and are quite amused by the characterizations of the report. For example, do you notice how when the rate falls by a tenth that is an “improvement,” but when it ticks up a tenth it is “essentially unchanged?” The Journal’s analysis wants to focus on upward revisions to last year’s estimates from an average of 153k per month to 181k per month. That means instead of being 100k short of breakeven per month we’re only 70k short of breakeven per month? Say nothing of the fact that 2012 is over! Are we going to make different business and investment decisions based on an estimated “improvement” from last year? It’s utterly ludicrous!

This is why you read us, folks. No spin, just an objective analysis of the data (with occasional commentary on how policy affects the data.) Remember, the data is not “good” or “bad.” It’s just data that requires the people who invest real money and employ real people to make sound decisions based on the objective analysis of the data. So, analysis can be “good” or “bad” and decisions can be “good” or “bad” but the data is just data.

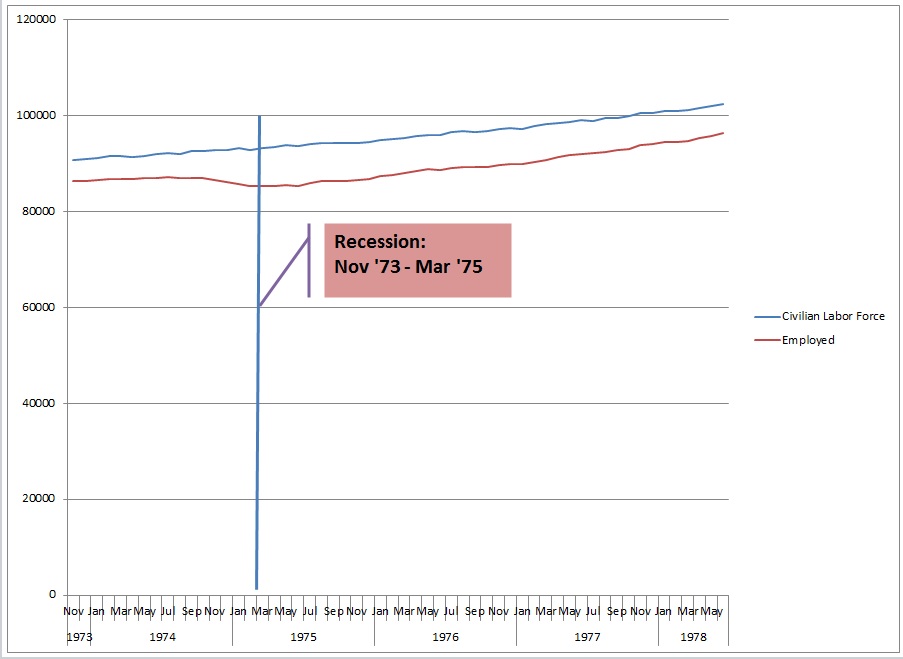

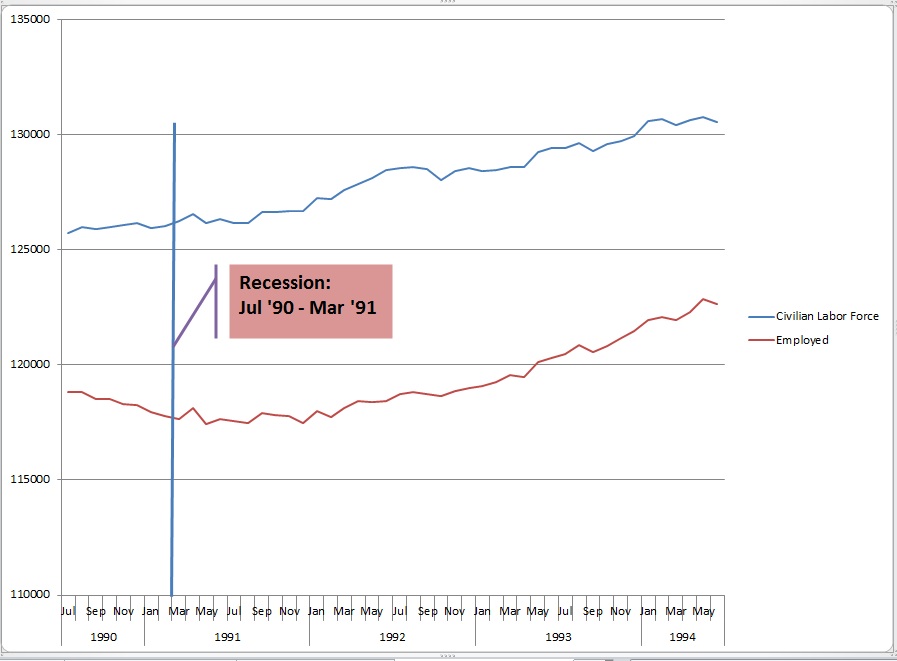

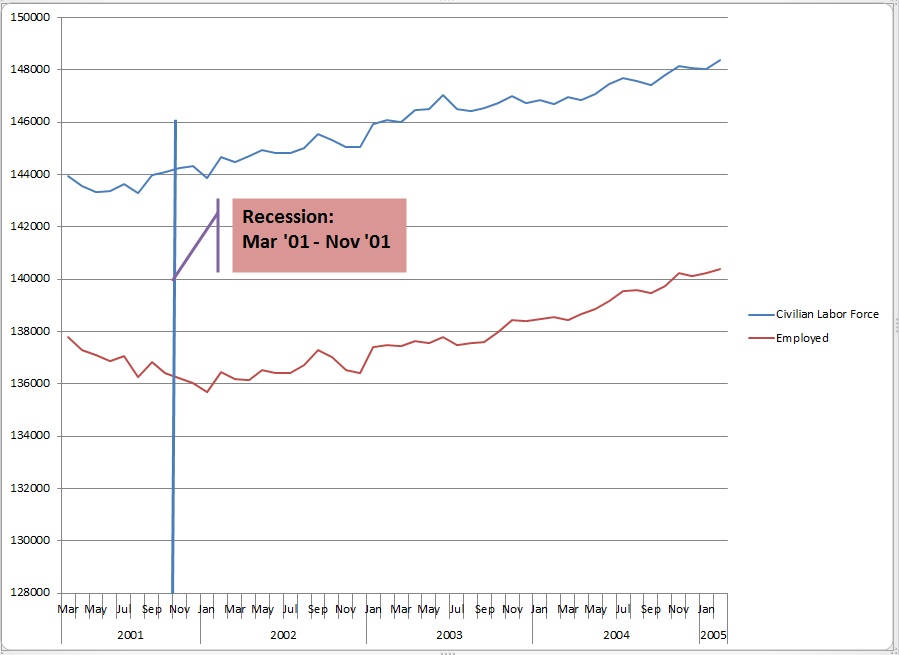

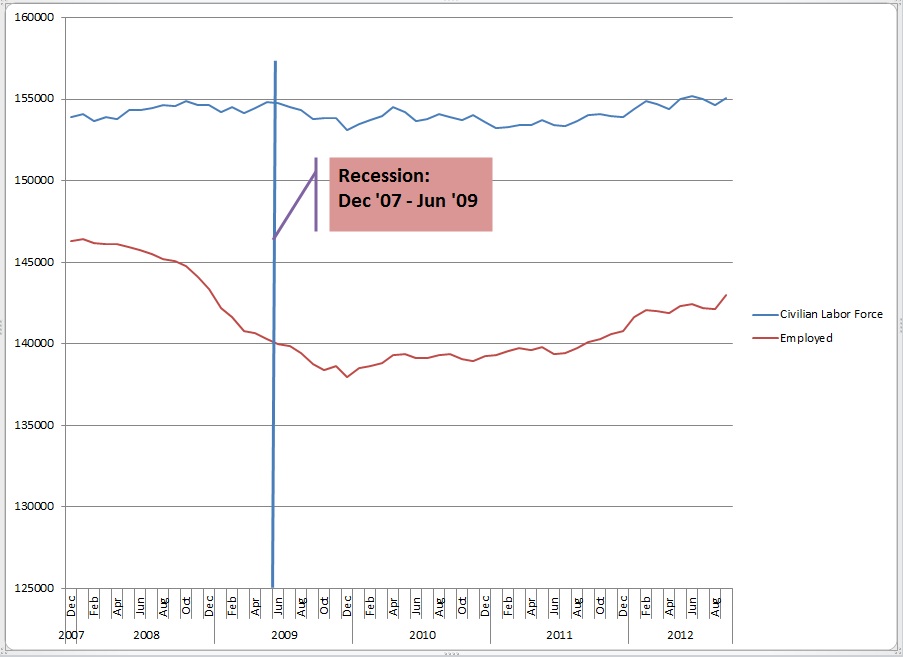

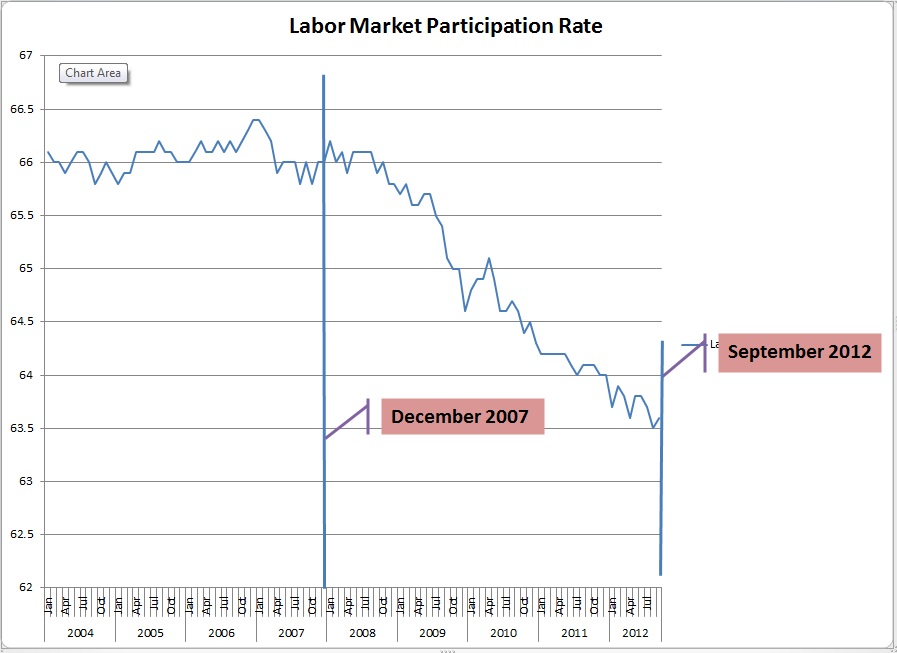

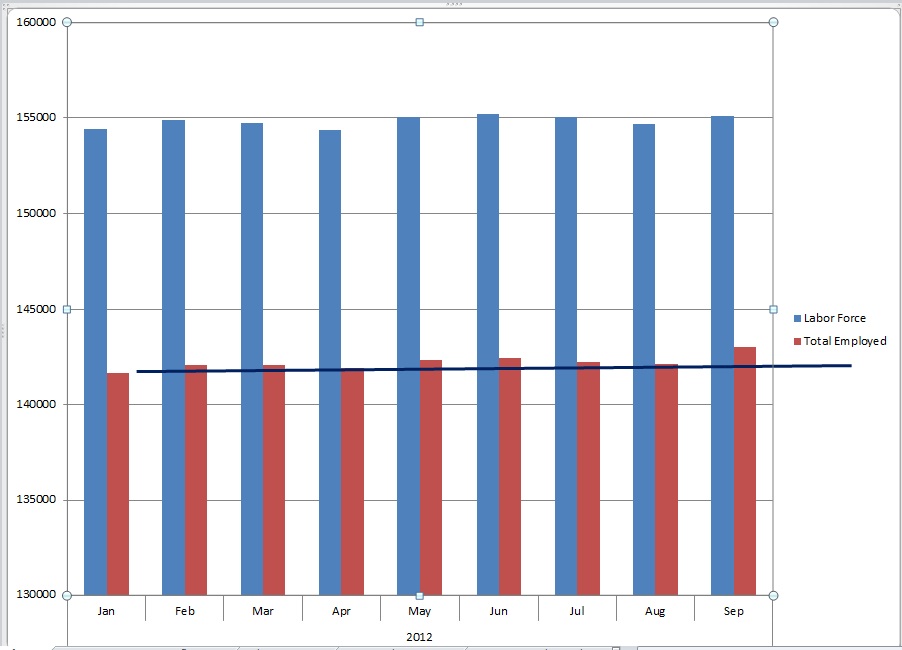

Some quick numbers, then… The rate ticked up to 7.9%, but so what? We’ve shown how the unemployment rate is a poor indicator of labor market health these days based on the ratio of the labor force size and the total number employed. This month is no exception. That observation is validated by the facts that the participation rate is unchanged for three months during an overall downward trend during 2012 (as long as we’re focusing on 2012), the total number of people not in the labor force increased, and the total number of people reporting as in the labor force but unemployed rose again!

The work week for all employees is unchanged and short for three months, but construction AND manufacturing showed a reduction in the length of the work week for all employees as well as production and non-supervisory employees. That hasn’t happened in a while. There were notable downward revisions to hourly and weekly wages in manufacturing, and the preliminary data for last month shows a decline over those downward revisions.

Is there more? Yeah, but I think we get it.

We analyze over one hundred reports per month. Occasionally we do a post regarding other economic reports, but the employment report is the one we post our analysis of every month. That’s because it gives the investor and business manager the most insight into the economy. Why? Because it tells us who’s not working and for how long; who is working and for how many hours per week in which industries; plus how much they’re making. That eliminates most of the potential surprises in the other reports that come out. For example, was the negative GDP report from earlier this week a surprise? Not if you’ve followed us!

I’ll be on CBS radio Chicago (WBBM AM 780, 105.9 FM) to analyze next month’s jobs report and the economy in general on Friday, March 8th. A couple of the reports we will be paying particular attention to during month are the consumer mood reports and the income and outlays reports. The consumer mood indicators have already taken a beating and we expect those to remain weak. We predicted that based on the realization that everybody’s paychecks got lighter, not just the $250k/yr + crowd. Next month the effect of 2012 year-end bonuses and dividend income should be gone but the tax bite will still be there. Add this to what we said about wages in manufacturing and we can see the potential for income and outlays to fall tracing the consumer mood values. If that plays out we’ll start to see the effects reflect in the weekly data on retail sales, durable goods orders, etc.

The market is still rising, but remember how fickle it can be. Let’s ride the wave as long and as well as we can, but make sure the defense is ready to deploy. We advise business managers to be watching the economic reports and industry data as closely as their own internals with plans in place for various hypotheticals. Call us if you’d like some help with that.

Have a great February. Thanks for reading and, please, stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, Ltd. who does not warrant or guarantee predictions based on its analysis.

©Blue World Asset Managers, LTD Friday, February 01, 2013