Blue World Employment Situation Report Analysis

Release Date: Usually on the first Friday of the month

Release Site: www.bls.gov

Market Impact: Usually Very High

Management Value: Critical

Date: October 6, 2017

Brain Surgery is not Rocket Science to a Brain Surgeon©

Should we panic? Perhaps…but not because of this jobs report. Today was a fascinating exercise in data collection and analysis. There is absolutely no reason to go into most of the actual numbers this month, but we have to go through the positives and negatives because, taken at face value, this report is awesome! In fact, if we were to be given the detail in advance and asked to predict job growth based on them, we’d have projected between 200k and 225k.

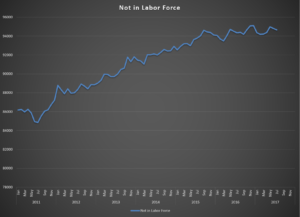

The Labor Force, Total Employed, Participation Rate, and Employed-Population Ratio all grew by very healthy margins. The Unemployment Rate, Total Unemployed, and Not in Labor Force totals all fell…by very healthy margins! The bad news was all in the headlines. Is there an explanation? Yup.

The obvious answer is the active hurricane season. But how does that throw this report into chaos? One example, without going too deep into the weeds, the report data is acquired from two different surveys, Household, which surveys individuals, and Establishment, which surveys employers. This is an unusual circumstance in that one who is counted as employed by one survey is counted as unemployed in the other based on whether they got paid. As we might suspect, the hospitality industry took it on the chin, so a lot of folks with “jobs” didn’t end up working and didn’t get “paid.” A major data point we were waiting to see was the response rate. We can get significant revisions to the jobs report over the two months following each release as many send their survey responses late. This month we fully expected the timely response rate to be way down. It wasn’t. According to the BLS, response rates were within normal limits in and out of the hurricane affected regions.

So…pay no attention to the details behind the curtain EXCEPT the revisions. The only meaningful data point to come out of this report is the net -38k revisions to July and August. That brings the three-month headline down to a 91k average for Q3 2017. That is simply not good enough.

At writing, S&P futures are trending down, but there is no indication of a gap-down vertical graph, so it seems the markets will take this in stride understanding the temporary nature of a report that will undoubtedly revise between now and year end.

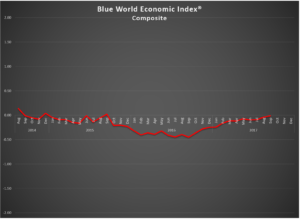

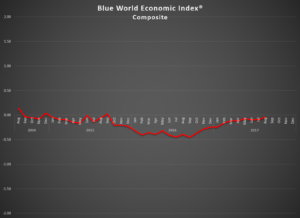

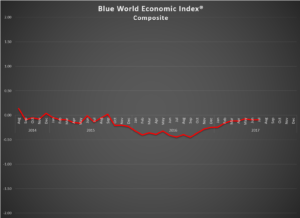

For more on the overall state of the economy you’re invited to review the Blue World Economic Index® Report for September which posted earlier this week. We’ll have no choice but to downgrade the index value for this report under the Employment category, but it won’t be as severe as the numbers imply for all the anomalous reasons listed above.

Have a great and safe Halloween, and we’ll meet back here for the next Employment Situation release, which is scheduled for Friday, November 3.

Thanks for reading, and please stay tuned…

Release Site: www.bls.gov

Every effort is made to ensure accuracy of data transcription but accuracy cannot be guaranteed. The official release site should be cross referenced. The analysis represents the opinion of Blue World Asset Managers, LTD. who does not warrant or guarantee predictions based on its analysis.